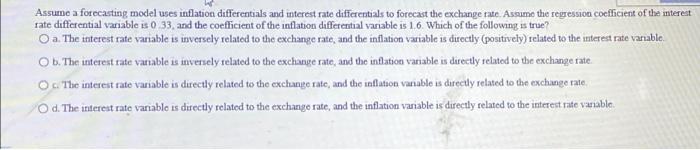

Question: Assume a forecasting model uses inflation differentials and interest rate differentials to forecast the exchange rate. Assume the regression coefficient of the iterest rate differential

Assume a forecasting model uses inflation differentials and interest rate differentials to forecast the exchange rate. Assume the regression coefficient of the iterest rate differential variable is 0 33 and the coefficient of the inflation differential variable is 16 Which of the following is true? a. The interest rate vanable is inversely related to the exchange rate, and the inflation variable is directly (positively related to the interest rate variable. b. The interest rate variable is inversely related to the exchange rate, and the inflation variable is directly related to the exchange rate. O The interest rate variable is directly related to the exchange rate, and the inflation variable is directly related to the exchange rate Od. The interest rate vanable is directly related to the exchange rate, and the inflation variable is directly related to the interest rate variable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts