Question: Assume a portfolio manager has a long position in two fixed income securities as follows: Bond A: 8-year, 8 per cent annual coupon bond at

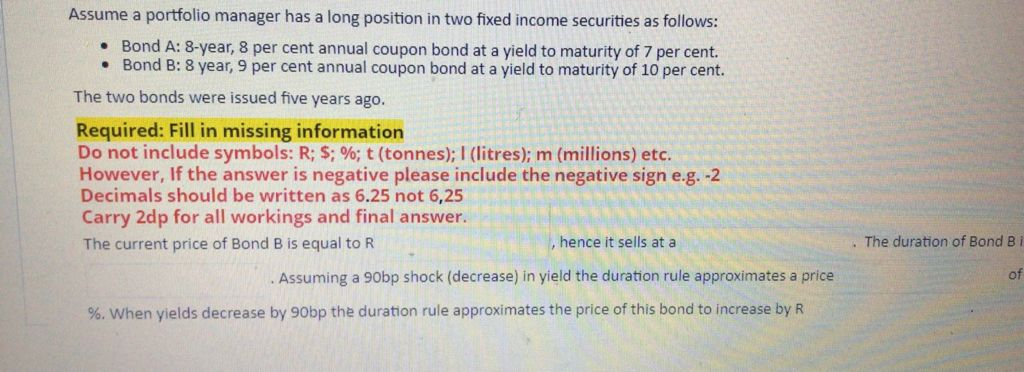

Assume a portfolio manager has a long position in two fixed income securities as follows: Bond A: 8-year, 8 per cent annual coupon bond at a yield to maturity of 7 per cent. Bond B: 8 year, 9 per cent annual coupon bond at a yield to maturity of 10 per cent. The two bonds were issued five years ago. Required: Fill in missing information Do not include symbols: R; $; %; t (tonnes); 1 (litres); m (millions) etc. However, If the answer is negative please include the negative sign e.g. -2 Decimals should be written as 6.25 not 6,25 Carry 2dp for all workings and final answer. The current price of Bond B is equal to R hence it sells at a The duration of Bond Bi Assuming a 90bp shock (decrease) in yield the duration rule approximates a price of %. When yields decrease by 90bp the duration rule approximates the price of this bond to increase by R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts