Question: Assume a property has 200,000 SF. The existing rent is $90 SF/Yr. Operating expenses are $30 SF/Yr. And the prevailing cap rate for properties

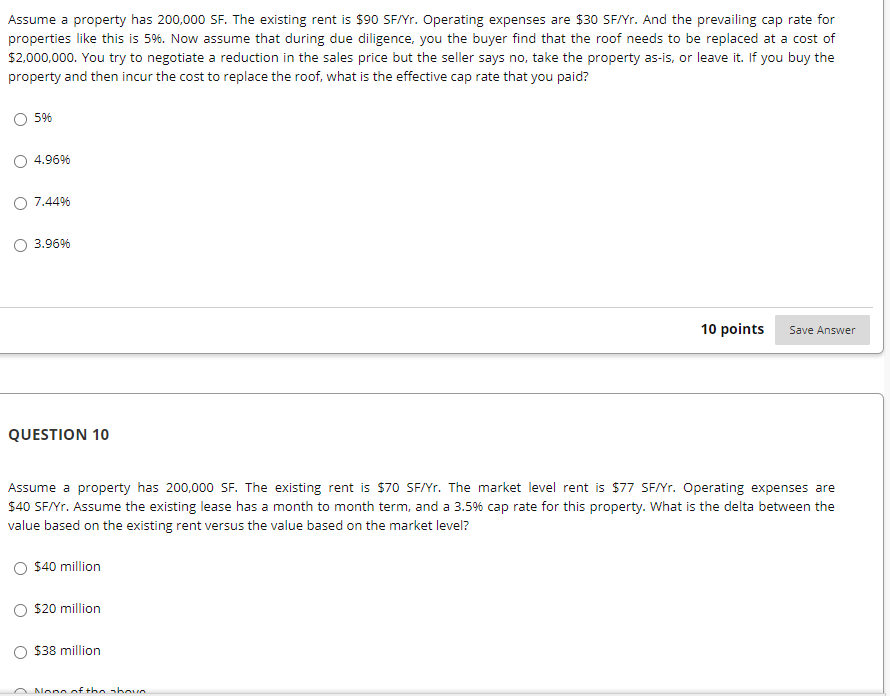

Assume a property has 200,000 SF. The existing rent is $90 SF/Yr. Operating expenses are $30 SF/Yr. And the prevailing cap rate for properties like this is 5%. Now assume that during due diligence, you the buyer find that the roof needs to be replaced at a cost of $2,000,000. You try to negotiate a reduction in the sales price but the seller says no, take the property as-is, or leave it. If you buy the property and then incur the cost to replace the roof, what is the effective cap rate that you paid? 5% 4.96% O 7.449% 3.96% 10 points Save Answer QUESTION 10 Assume a property has 200,000 SF. The existing rent is $70 SF/Yr. The market level rent is $77 SF/Yr. Operating expenses are $40 SF/Yr. Assume the existing lease has a month to month term, and a 3.5% cap rate for this property. What is the delta between the value based on the existing rent versus the value based on the market level? $40 million $20 million $38 million O None of the abon

Step by Step Solution

3.32 Rating (176 Votes )

There are 3 Steps involved in it

PLEASE THUMBS UP IT IS VERY MOTIVATING IF ANY ISSUE ... View full answer

Get step-by-step solutions from verified subject matter experts