Question: Assume all Forms W-4 are from 2021 or later using Standard withholding for this activity. Use Tax Tables A and B, located @ T-1 in

Assume all Forms W-4 are from 2021 or later using Standard withholding for this activity.

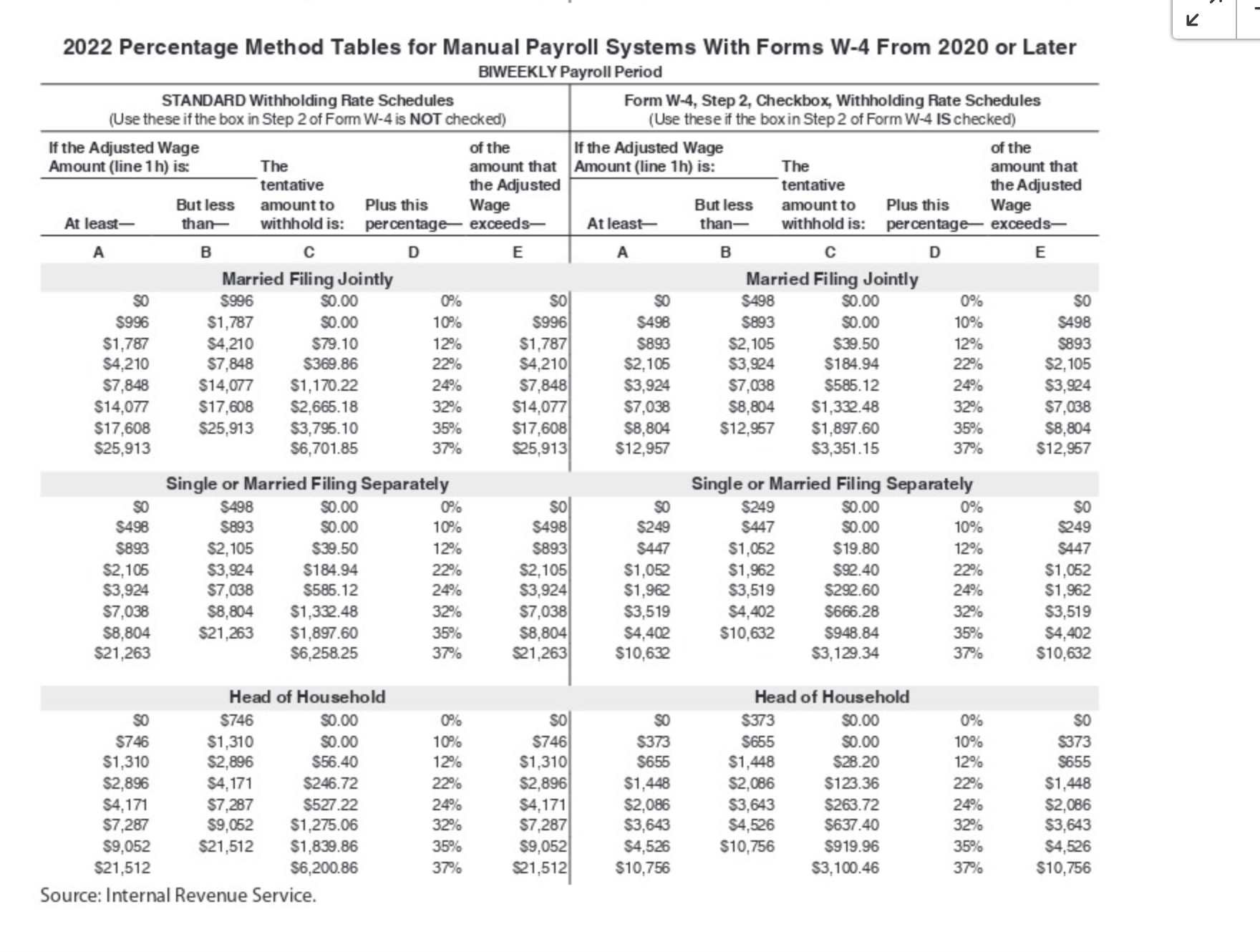

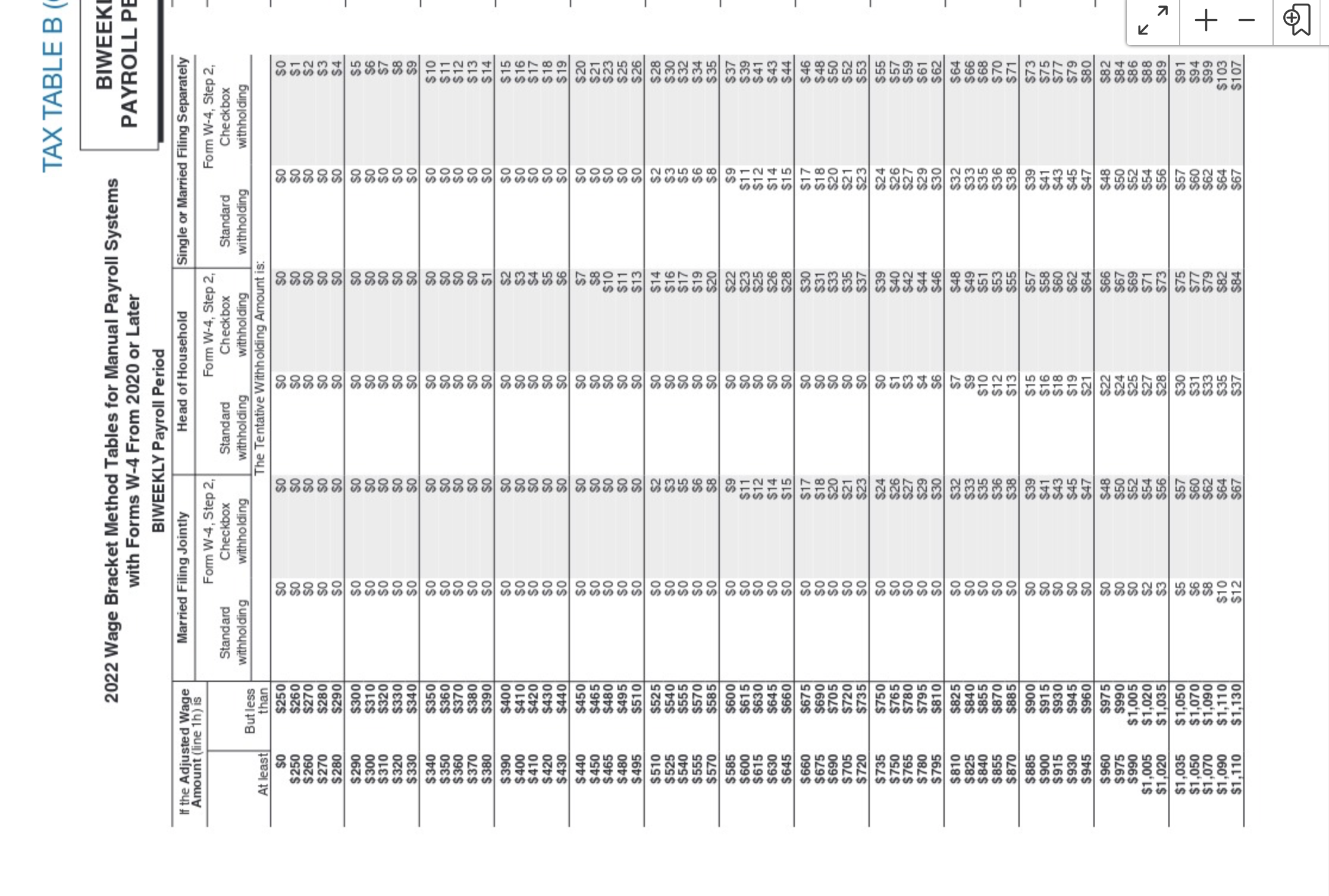

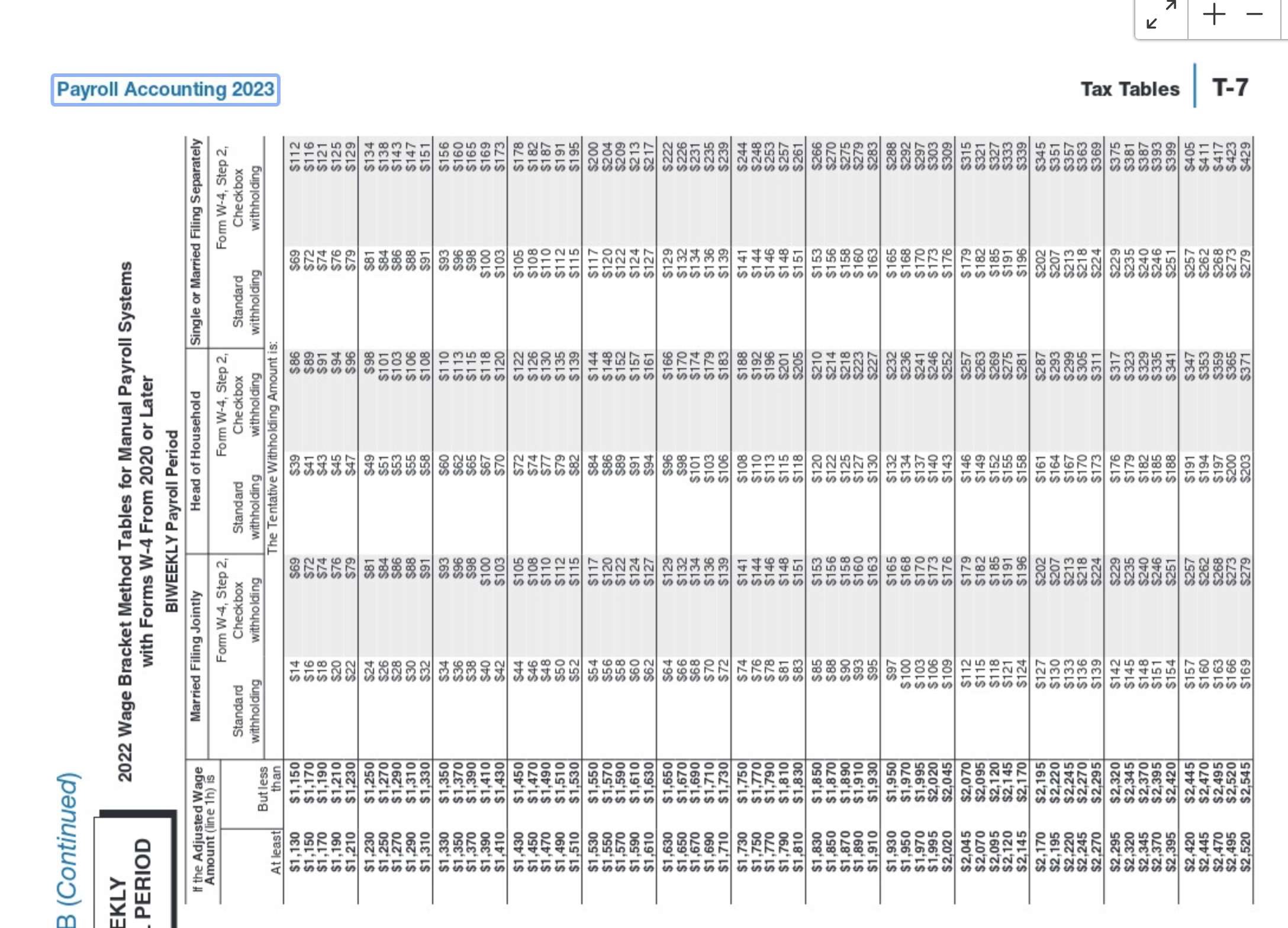

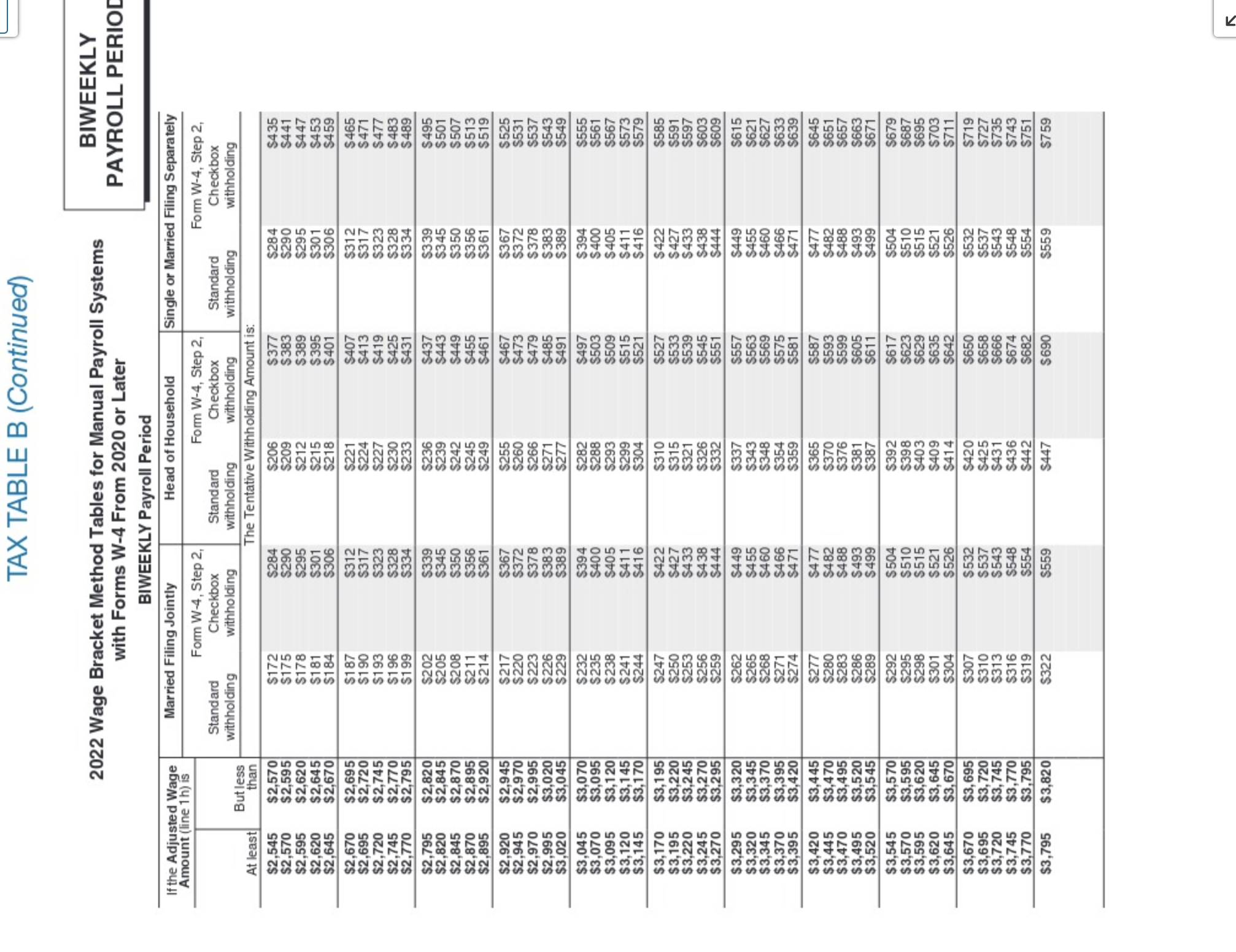

Use Tax Tables A and B, located @ T-1 in your Ebook.

- Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket):

- Karen Overton (single), $900 wages

- Nancy Haller (married filing separately), $1,000 wages

- Alan Glasgow (married filing jointly), $980 wages

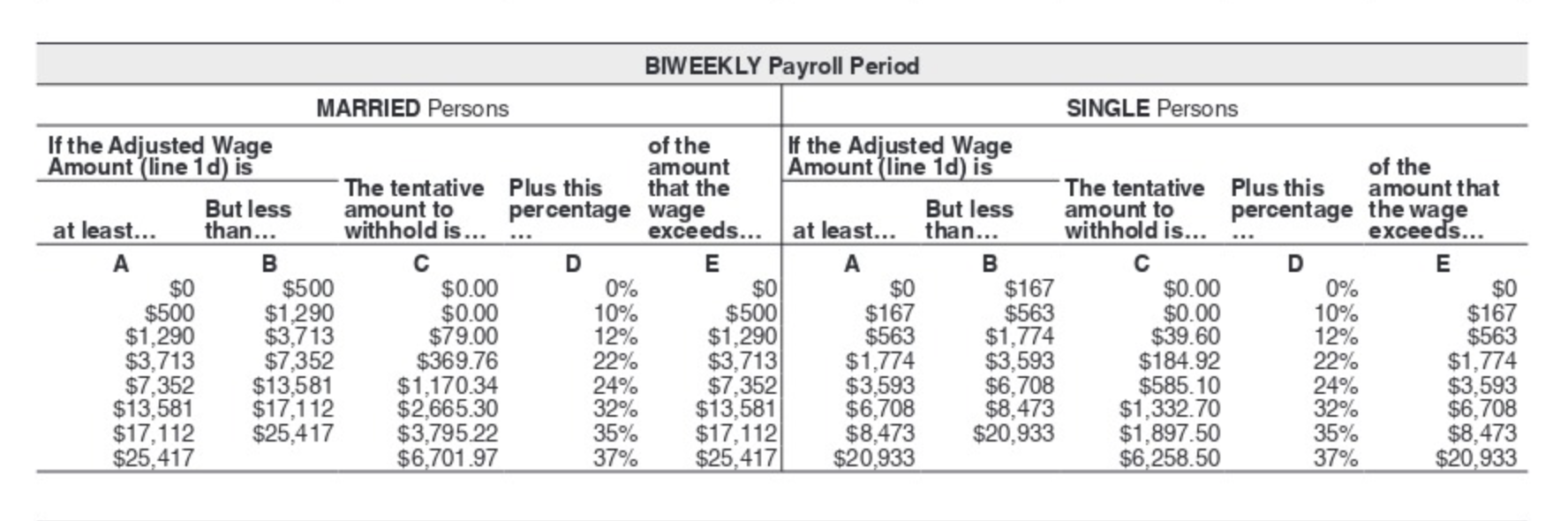

2. Calculate the amount to withhold from the following employees using the biweekly table of the percentage method.

- Kenneth Karcher (single), $895 wages

- Mary Kenny (married filing jointly), $3,900 wages

2022 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted Wage of the Amount (line 1h) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted tentative the Adjusted But less amount to Plus this Wage But less amount to Plus this Wage At least- than withhold is: percentage- exceeds- At least- than- withhold is: percentage- exceeds- B D E B C E Married Filing Jointly Married Filing Jointly SO $996 $0.00 0% SO SO $498 $0.00 0% SO $996 $1,787 $0.00 10% $996 $498 $893 $0.00 10% $498 $1,787 $4,210 $79.10 12% $1,787 $893 $2, 105 $39.50 12% $893 $4,210 $7,848 $369.86 22% $4,210 $2, 105 $3,924 $184.94 22% $2, 105 $7,848 $14,077 $1,170.22 24% $7,848 $3,924 $7,038 $585.12 24% $3,924 $14,077 $17,608 $2,665.18 32% $14,077 $7,038 $8.804 $1,332.48 32% $7,038 $17,608 $25,913 $3,795.10 35% $17,608 $8,804 $12,957 $1,897.60 35% $8,804 $25,913 $6,701.85 37% $25,913 $12,957 $3,351.15 37% $12,957 Single or Married Filing Separately Single or Married Filing Separately SO $498 $0.00 0% SO SO $249 $0.00 0% SO $498 $893 $0.00 10% $498 $249 $447 $0.00 10% $249 $893 $2, 105 $39.50 12% $893 $447 $1,052 $19.80 12% $447 $2, 105 $3,924 $184.94 22% $2, 105 $1,052 $1,962 $92.40 22% $1,052 $3,924 $7,038 $585.12 24% $3,924 $1,962 $3,519 $292.60 24% $1,962 $7,038 $8,804 $1,332.48 32% $7,038 $3,519 $4,402 $666.28 32% $3,519 $8,804 $21,263 $1,897.60 35% $8,804 $4,402 $10,632 $948.84 35% $4,402 $21,263 $6,258.25 37% $21,263 $10,632 $3,129.34 37% $10,632 Head of Household Head of Household SO $746 $0.00 0% So SO $373 $0.00 0% SO $746 $1,310 $0.00 10% $746 $373 $655 $0.00 10% $373 $1,310 $2,896 $56.40 12% $1,310 $656 $1,448 $28.20 12% $655 $2,896 $4,171 $246.72 22% $2,896 $1,448 $2,086 $123.36 22% $1,448 $4,171 $7,287 $527.22 24% $4,171 $2.086 $3,643 $263.72 24% $2,086 $7.287 $9.052 $1,275.06 32% $7,287 $3,643 $4,526 $637.40 32% $3,643 $9,052 $21,512 $1,839.86 35% $9,052 $4,526 $10,756 $919.96 35% $4,526 $21,512 $6,200.86 37% $21,512 $10,756 $3, 100.46 37% $10,756 Source: Internal Revenue Service.85 E 3 En So m5 2: 5 o: 5 no; #3 Non mm\" 3% o; 05.; 03.5 #1 ma NS 2 R 8a 8 oSi 2!; an S E :3 8a 3 Sb. 5 So. 5 an E m5 can E m can. 5 use. 5 2 m8 om n5 awn Sn mm 28 5 8 5 v. 3. E F Ru .3 mm o8. 5 3o. 5 awn Nm m8 mm\" a on mac. 5 coon van cm 30 vwa 30 on 008 whom I Na. 3. as aw ova on :8 83 can 3. v3 an 9a or. can neon as m3 N8 9 no on 38 83 K m3. 8a Eu new on can 23 m5 3 3o 2 S on n 5 So I an on E m 5 an on 33 33 K an 3 n 3 an on ma Eb on wnm nmo NE an on 2.3 mm. 8n mm. 5a a; man on an\" 30 won an. 9a an a on 33 an 3 mm 9o nu Nun on mu. 9: Na own 9 am on on o 5 was So awn 3o 3 own on no; 92. mmn hm N3 nu R on 2:. we; 5 wmm 3 G wwu on 35 SR 1 m N on\" ca mm on cub was\" 8 mm 5 3 mm on nab 9E. mm Fm m8 3 an on as 35 cm 0N Ho on own on no; coon 3a a 5 F8 on 05 or. 008 {ha 9\" h 5 can on 2 on =8 98 3a m 5 UN 8 m.\" on ouch new 9 v 5. w\" on 3 on 38 one 5n N 5 mm\" 8 N\" on gun Eon on F 5 awn 3 :a on n Ea Sou B an a on a on can an mm an own 3 8 on non Eh can on m5 3 3 on Eh Bun Nna mm Cu on mm on man ova 8n mm o5 on n on 33 an on mu 3 on W on man 0:. own 0 M5 or. on on 0 5n nova mm on In 3 on on no; on; No on Eu 3 8 on one 33 an on 8 3 on cm 33 an; own on R 3 8 on 28 03a 2 a on 3 3 on on :3 an; 2 a on ma 3 on on on; cm; 2 n on vn on on om ON; 0; w n on ma on on on 0 3n 93 m a om Nu on 8 on so; can 1 a on 5 on on or. on.\" can 2 a on on on on on a!\" n ~ a on on 3 8 on 3.8 33 .5 cm on 3 8 on can Sn 2 cm on 3 8 on Sam 33 mm c on 3 8 on 33 Sam 8 cm on on 8 on on.\" can hm on on c on on can\" Sun on em 8 o 8 on o 5 can m on no 3 8 on 33 Sun 0 on on on 8 on sown 8N5 nn 3 on S 8 on can 2N ~n on on S 8 on as Ban 5 on on 3 on 3 33 8am on on on on 8 on on\" 3 \"2 E395 Sgggoc \"my .31? 95.9.5.3 95.9.5? Duo9.5.3 SUE? 9.5.353 25 53.35 255% x835 Euucsm 39.85 I .N 33m 6.; E5\". .N 3% .7; 5.0. .N 98m {LS EB\". u a: 2: .555 20583 2:: not! 5 0.9% g 22:2. BEE not! can; 9.82:: as = 3.0L =93... >Jxmm>2m .23 .o 82 Eat Is seam 3 331$ :35 .55: .2 333 .650: 8.85 can? now mn 440m>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts