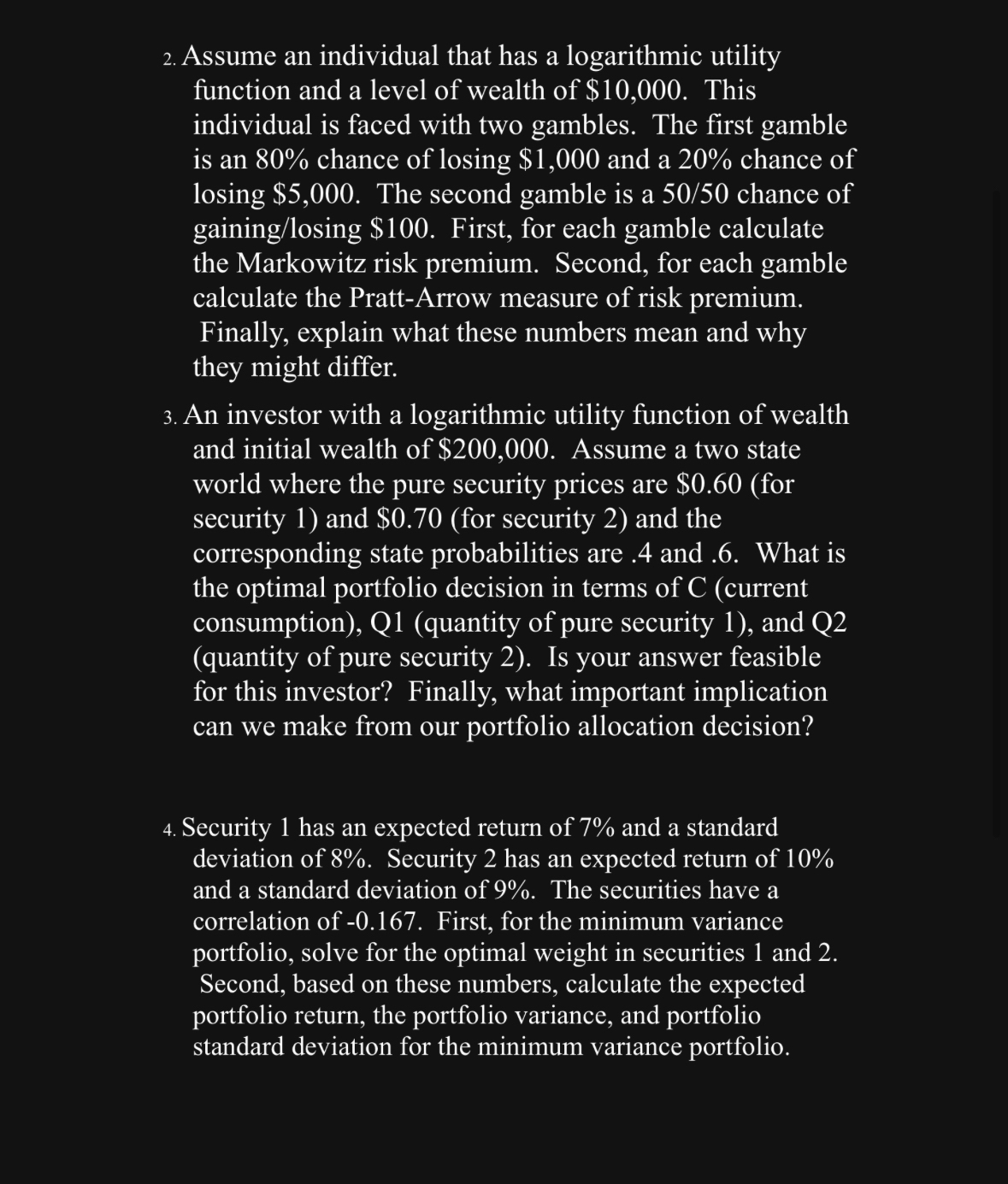

Question: Assume an individual that has a logarithmic utility function and a level of wealth of $ 1 0 , 0 0 0 . This individual

Assume an individual that has a logarithmic utility

function and a level of wealth of $ This

individual is faced with two gambles. The first gamble

is an chance of losing $ and a chance of

losing $ The second gamble is a chance of

gaininglosing $ First, for each gamble calculate

the Markowitz risk premium. Second, for each gamble

calculate the PrattArrow measure of risk premium.

Finally, explain what these numbers mean and why

they might differ.

An investor with a logarithmic utility function of wealth

and initial wealth of $ Assume a two state

world where the pure security prices are $for

security and $for security and the

corresponding state probabilities are and What is

the optimal portfolio decision in terms of C current

consumption Qquantity of pure security and Q

quantity of pure security Is your answer feasible

for this investor? Finally, what important implication

can we make from our portfolio allocation decision?

Security has an expected return of and a standard

deviation of Security has an expected return of

and a standard deviation of The securities have a

correlation of First, for the minimum variance

portfolio, solve for the optimal weight in securities and

Second, based on these numbers, calculate the expected

portfolio return, the portfolio variance, and portfolio

standard deviation for the minimum variance portfolio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock