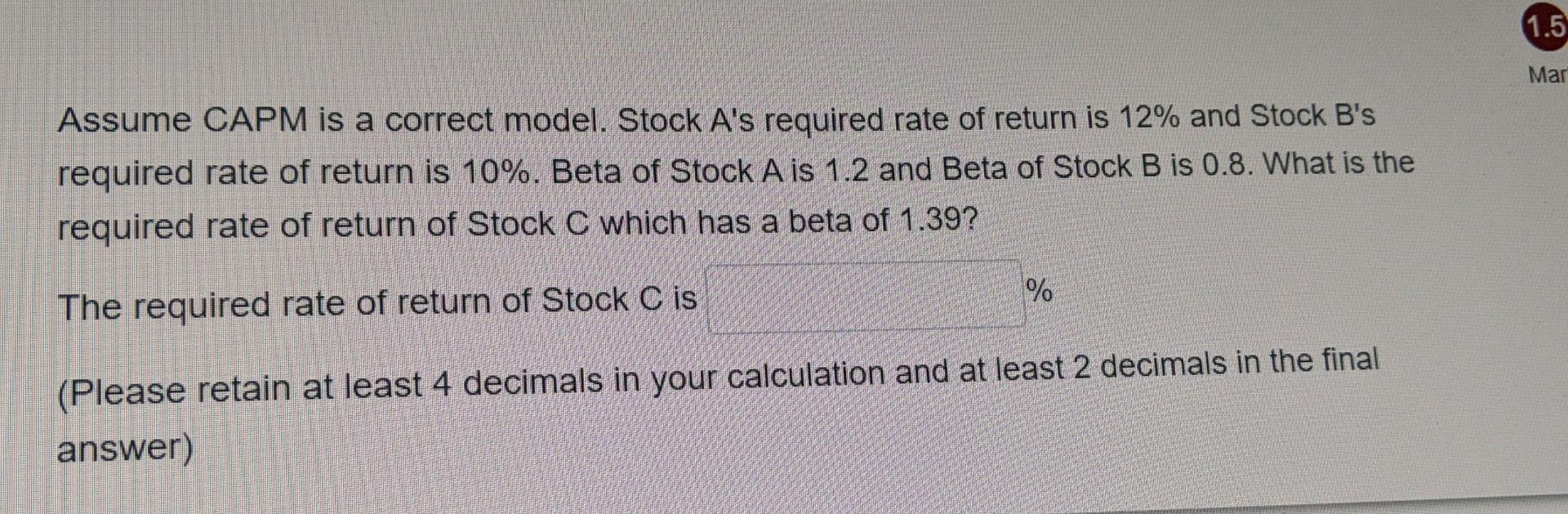

Question: Assume CAPM is a correct model. Stock A's required rate of return is 12% and Stock B's required rate of return is 10%. Beta of

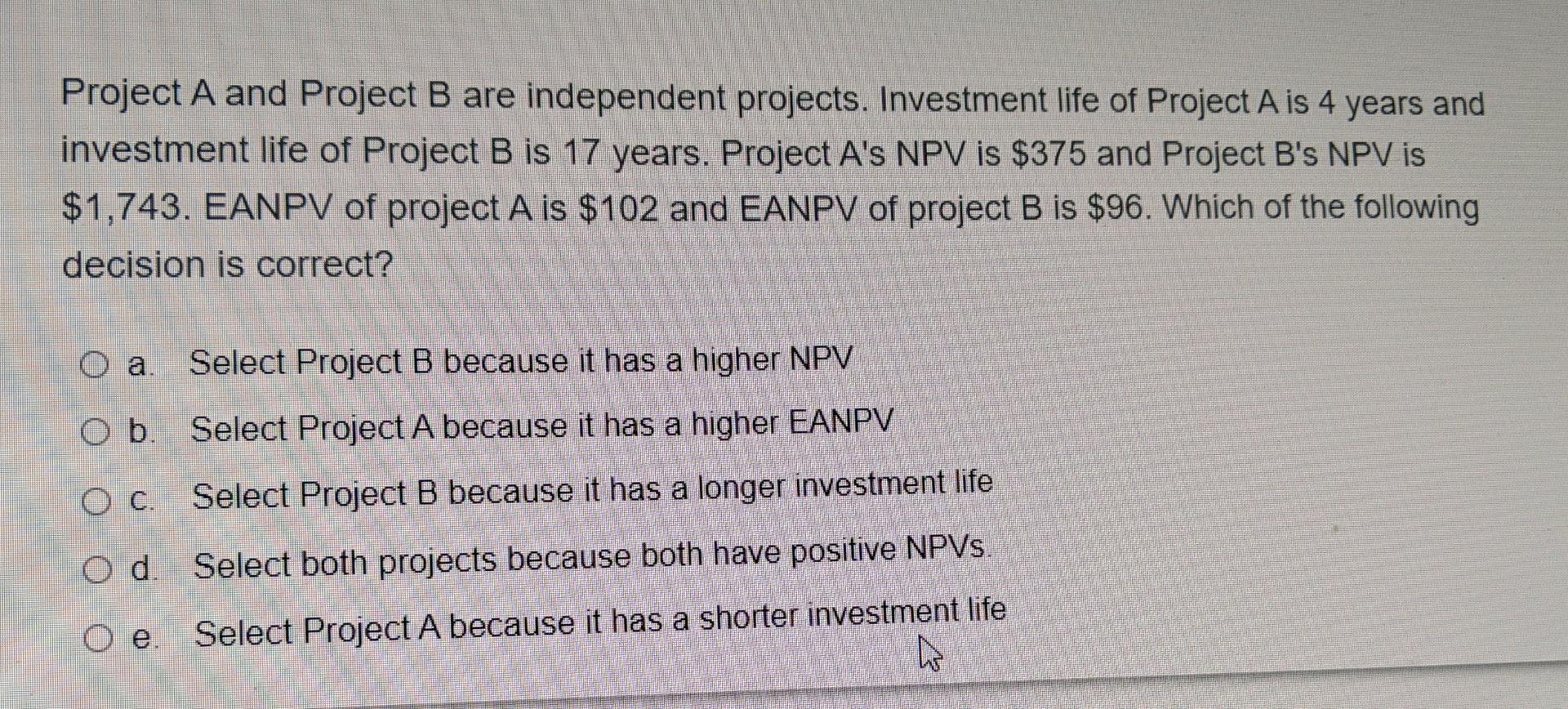

Assume CAPM is a correct model. Stock A's required rate of return is 12% and Stock B's required rate of return is 10%. Beta of Stock A is 1.2 and Beta of Stock B is 0.8. What is the required rate of return of Stock C which has a beta of 1.39? % The required rate of return of Stock C is (Please retain at least 4 decimals in your calculation and at least 2 decimals in the final answer) 1.5 Mar Project A and Project B are independent projects. Investment life of Project A is 4 years and investment life of Project B is 17 years. Project A's NPV is $375 and Project B's NPV is $1,743. EANPV of project A is $102 and EANPV of project B is $96. Which of the following decision is correct? O a. Select Project B because it has a higher NPV O b. Select Project A because it has a higher EANPV O C. O d. Select Project B because it has a longer investment life Select both projects because both have positive NPVs. Select Project A because it has a shorter investment life 4 e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts