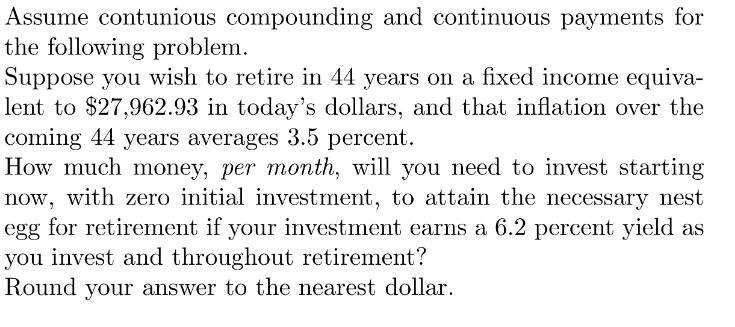

Question: Assume contunious compounding and continuous payments for the following problem. Suppose you wish to retire in 4 4 years on a fixed income equiva -

Assume contunious compounding and continuous payments for

the following problem.

Suppose you wish to retire in years on a fixed income equiva

lent to $ in today's dollars, and that inflation over the

coming years averages percent.

How much money, per month, will you need to invest starting

now, with zero initial investment, to attain the necessary nest

egg for retirement if your investment earns a percent yield as

you invest and throughout retirement?

Round your answer to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock