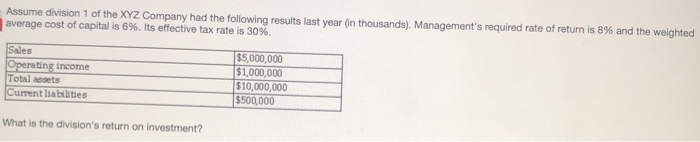

Question: Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted

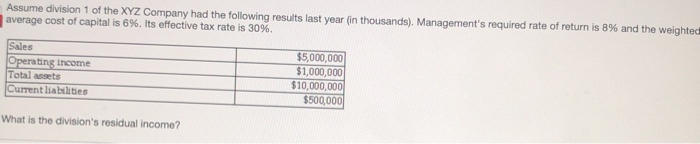

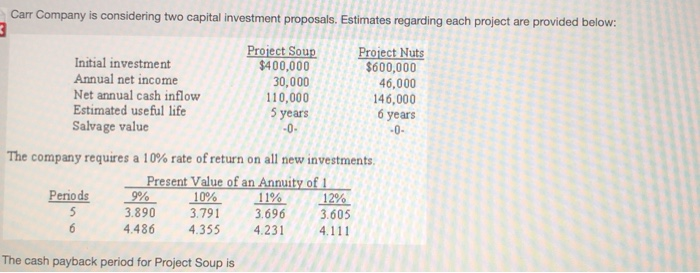

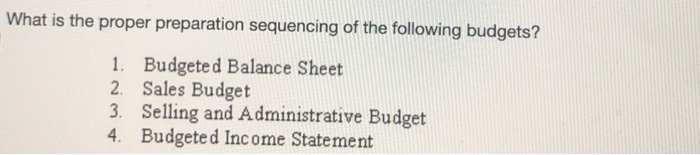

Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%. Sales Operating income Total assets Current liabilities $5,000,000 $1,000,000 $10,000,000 $500,000 What is the division's return on investment? Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%. Sales Operating income Total assets Current liabilities $5,000,000 $1,000,000 $10,000,000 $500,000 What is the division's residual income? Carr Company is considering two capital investment proposals. Estimates regarding each project are provided below: Initial investment Annual net income Net annual cash inflow Estimated useful life Salvage value Project Soup $400,000 30,000 110,000 5 years -0. Project Nuts $600,000 46,000 146,000 6 years -0- The company requires a 10% rate of return on all new investments, Present Value of an Annuity of 1 Periods 9% 10% 11% 12% 5 3.890 3.791 3.696 3.605 6 4.486 4.355 4.231 4.111 The cash payback period for Project Soup is What is the proper preparation sequencing of the following budgets? 1. Budgeted Balance Sheet 2. Sales Budget 3. Selling and Administrative Budget 4. Budgeted Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts