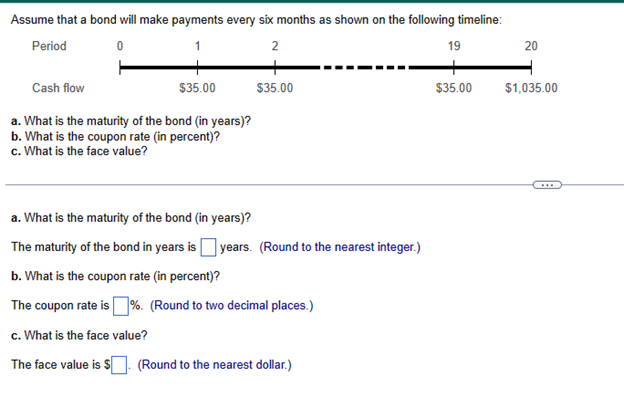

Question: Assume that a bond will make payments every six months as shown on the following timeline: Period 0 1 2 19 Cash flow $35.00

Assume that a bond will make payments every six months as shown on the following timeline: Period 0 1 2 19 Cash flow $35.00 a. What is the maturity of the bond (in years)? b. What is the coupon rate (in percent)? c. What is the face value? $35.00 a. What is the maturity of the bond (in years)? The maturity of the bond in years is years. (Round to the nearest integer.) b. What is the coupon rate (in percent)? The coupon rate is%. (Round to two decimal places.) c. What is the face value? The face value is $. (Round to the nearest dollar.) $35.00 20 $1,035.00

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

a To calculate the maturity of the bond we need to consider the periods between ... View full answer

Get step-by-step solutions from verified subject matter experts