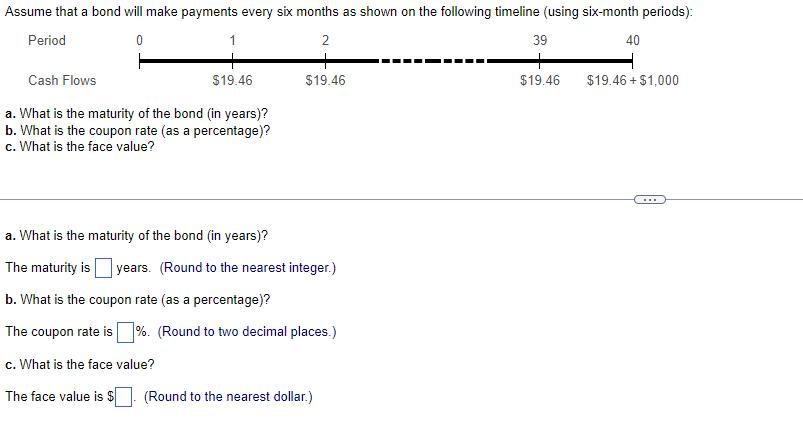

Question: Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): Period 40 0 Cash Flows

Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): Period 40 0 Cash Flows 2 + $19.46 $19.46 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) b. What is the coupon rate (as a percentage)? The coupon rate is %. (Round to two decimal places.) c. What is the face value? The face value is $ (Round to the nearest dollar.) 39 + $19.46 $19.46 +$1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts