Assume that a company is going to invest 900,000 USD in a new project. We expect...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

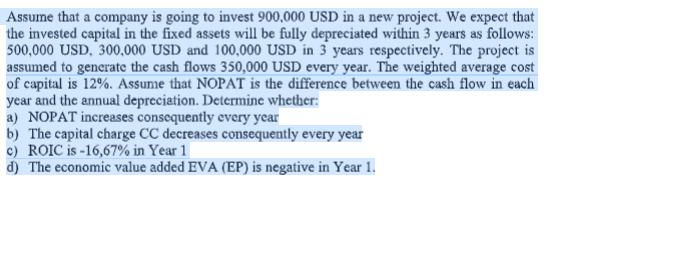

Assume that a company is going to invest 900,000 USD in a new project. We expect that the invested capital in the fixed assets will be fully depreciated within 3 years as follows: 500,000 USD, 300,000 USD and 100,000 USD in 3 years respectively. The project is assumed to generate the cash flows 350,000 USD every year. The weighted average cost of capital is 12%. Assume that NOPAT is the difference between the cash flow in each year and the annual depreciation. Determine whether: a) NOPAT increases consequently every year b) The capital charge CC decreases consequently every year c) ROIC is -16,67% in Year 1 d) The economic value added EVA (EP) is negative in Year 1. Assume that a company is going to invest 900,000 USD in a new project. We expect that the invested capital in the fixed assets will be fully depreciated within 3 years as follows: 500,000 USD, 300,000 USD and 100,000 USD in 3 years respectively. The project is assumed to generate the cash flows 350,000 USD every year. The weighted average cost of capital is 12%. Assume that NOPAT is the difference between the cash flow in each year and the annual depreciation. Determine whether: a) NOPAT increases consequently every year b) The capital charge CC decreases consequently every year c) ROIC is -16,67% in Year 1 d) The economic value added EVA (EP) is negative in Year 1.

Expert Answer:

Answer rating: 100% (QA)

To analyze whether NOPAT increases consequently every year whether the capital charge decreases cons... View the full answer

Related Book For

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope

Posted Date:

Students also viewed these finance questions

-

This case study on project evaluation is applicable for beginning courses in corporate finance or finance strategy. Two alternative investment options are available to evaluate. Challenges are...

-

Data for Sabanci Holding can be found in the table below. Theincome statement items correspond to revenues or costs during theyear ending in either 2018 or 2019. The balance sheet itemscorrespond t 2...

-

The Empire Manufacturing is considering acquisition of a new press machine for their manufacturing facility in Pennsylvania. They have two machines from which to select. Alternative A has a cost of...

-

What variables affect profitability? Name two methods for determining profitability when simultaneous changes occur in these variables.

-

Describe the consultative role of the ethics committee when addressing ethical dilemmas.

-

Hovington, CPA, knows that while audit objectives relating to inventories may be stated in terms of the assertions as presented in this chapter, they may also be subdivided and stated more...

-

1. How would you describe the basic components of WACC to a group of decision makers in a company? 2. On the most basic level, if a firm's WACC is 12 percent, what does this mean? 3. In calculating...

-

At the end of March, Weber Productions accounting records reveal a balance for cash equal to $21,861. However, the balance of cash in the bank at the end of February is only $4,576. Weber is...

-

The number of hits to a web site follows a poisson process hits occur at the rate of 0.5 per minute between 7:00 pm and 11:00 pm given below are three scenarios for the number of hits to the web site...

-

According to Elon Musk, his intentions were to make reforms to Twitter, such as cutting back on advertisements and boosting revenue. However, this has come with a lot of backlash from Twitter...

-

Identify gaps - research what other companies (or industries) are doing around sustainability that you think your chosen hotel/hotel company could be doing. These gaps could be around specific...

-

Contractor was hired by homeowner, in the construction of homeowner's residence, to install a standard of pipe known as "Smith Manufacture." The parties reduced the same to writing and entered into a...

-

The human heart creates the body's largest electromagnetic field. During normal beating, an electrocardiogram measures a voltage of 2.7 mV between two electrical contact pads on the chest that are...

-

The GoodTimes Frozen Food Company has a factory in Langley, BC and sales and distribution centers in Langley, Calgary, AB and Markum, ON. For many years the company's best selling product was a line...

-

Find the domain and range of the function f(x, y) = xeVF+I

-

Cleaning Service Company's Trial Balance on December 31, 2020 is as follows: Account name Debit Credit Cash 700 Supplies Pre-paid insurance Pre-paid office rent Equipment Accumulated depreciation -...

-

Many mistakes are made in business because the relevant amounts and factors are not properly identified rather than because the amounts are not correctly calculated. For each of the following...

-

For each of the following decisions or actions, indicate which of the three areas of managerial accounting apply. Select the best option by placing the corresponding letter in the space provided....

-

Traditional cost accounting systems typically distort product costs by overcosting the complex products and undercosting the simple products. ABC systems have been introduced primarily to correct...

-

The overall process of creating a capital budget proposal has a lot of similarities to writing a business plan for a start-up company. Describe three aspects of the similarities between a budget...

-

There are three general categories of capital budget scenarios: replacement, expansion, and investment in a NewCo. Describe the overall decision-making context for each. How do they draw on similar...

-

In analysis, some focus seems to be on the need for NPV equations to be applied to projects that are mutually exclusive. But in practice we find that the lines are blurred in capital budgeting....

Study smarter with the SolutionInn App