Question: assume that all variables ( i . e . revenue, costs, income, assets, etc. ) will grow by the same percentage. Due to the assumed

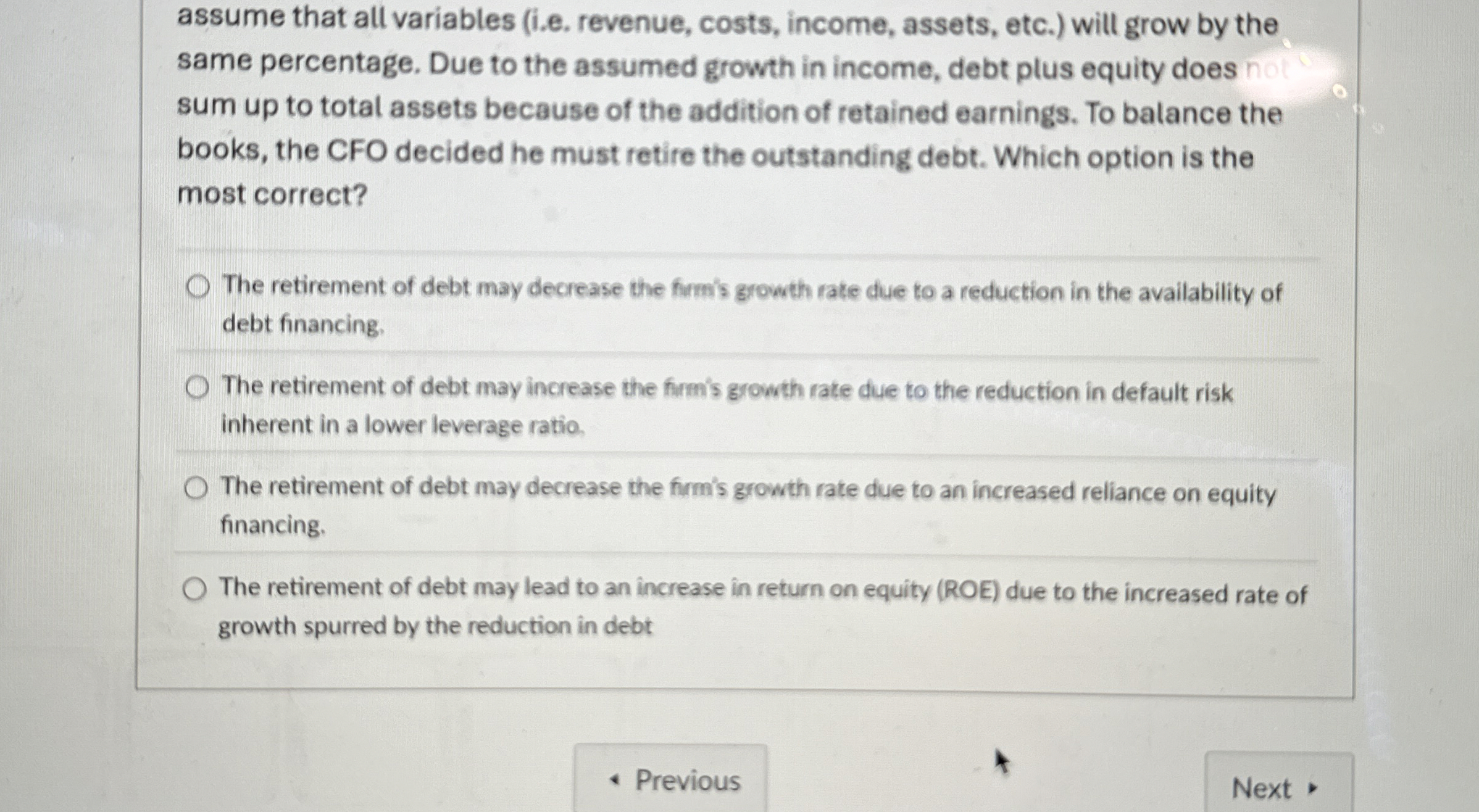

assume that all variables ie revenue, costs, income, assets, etc. will grow by the same percentage. Due to the assumed growth in income, debt plus equity does sum up to total assets because of the addition of retained earnings. To balance the books, the CFO decided he must retire the outstanding debt. Which option is the most correct?

The retirement of debt may decrease the firm's growth rate due to a reduction in the availability of debt financing.

The retirement of debt may increase the firm's growth rate due to the reduction in default risk inherent in a lower leverage ratio.

The retirement of debt may decrease the firm's growth rate due to an increased reliance on equity financing.

The retirement of debt may lead to an increase in return on equity ROE due to the increased rate of growth spurred by the reduction in debt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock