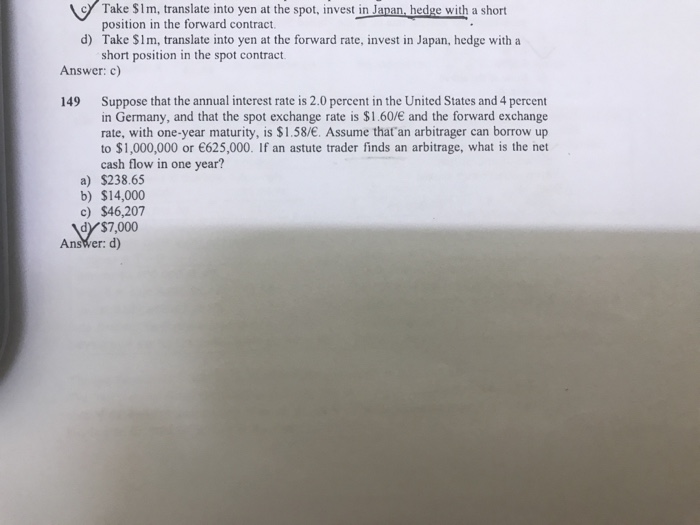

Question: assume that an arbitrager can borrow up e Take SIm, translate into yen at the spot, invest in Janan, hedge with a short position in

e Take SIm, translate into yen at the spot, invest in Janan, hedge with a short position in the forward contract. Take S1m, translate into yen at the forward rate, invest in Japan, hedge with a short position in the spot contract d) Answer: c) 149 Suppose that the annual interest rate is 2.0 percent in the United States and 4 percent in Germany, and that the spot exchange rate is $1.60/E and the forward exchange rate, with one-year maturity, is $1.58/. Assume that an arbitrager can borrow up to $1,000,000 or 625,000. If an astute trader finds an arbitrage, what is the net cash flow in one year? a) $238.65 b) $14,000 c)$46,207 d)y $7,000 Answer: d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts