Question: Assume that FedEx established a minimum required rate of return of 15% for each of its business segments. Compute the residual income earned in 2019

Assume that FedEx established a minimum required rate of return of 15% for each of its business segments. Compute the residual income earned in 2019 in each of FedExs four segments. To answer the question, you will need to download FedExs 2019 10-K or annual report for the fiscal year ended May 31, 2019

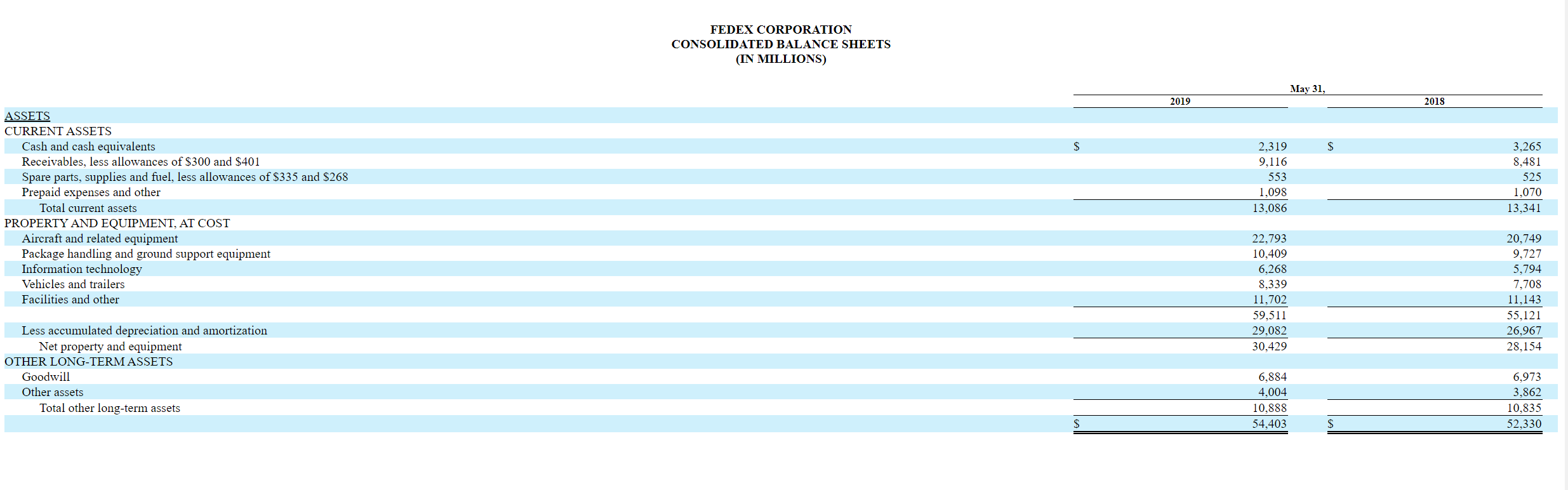

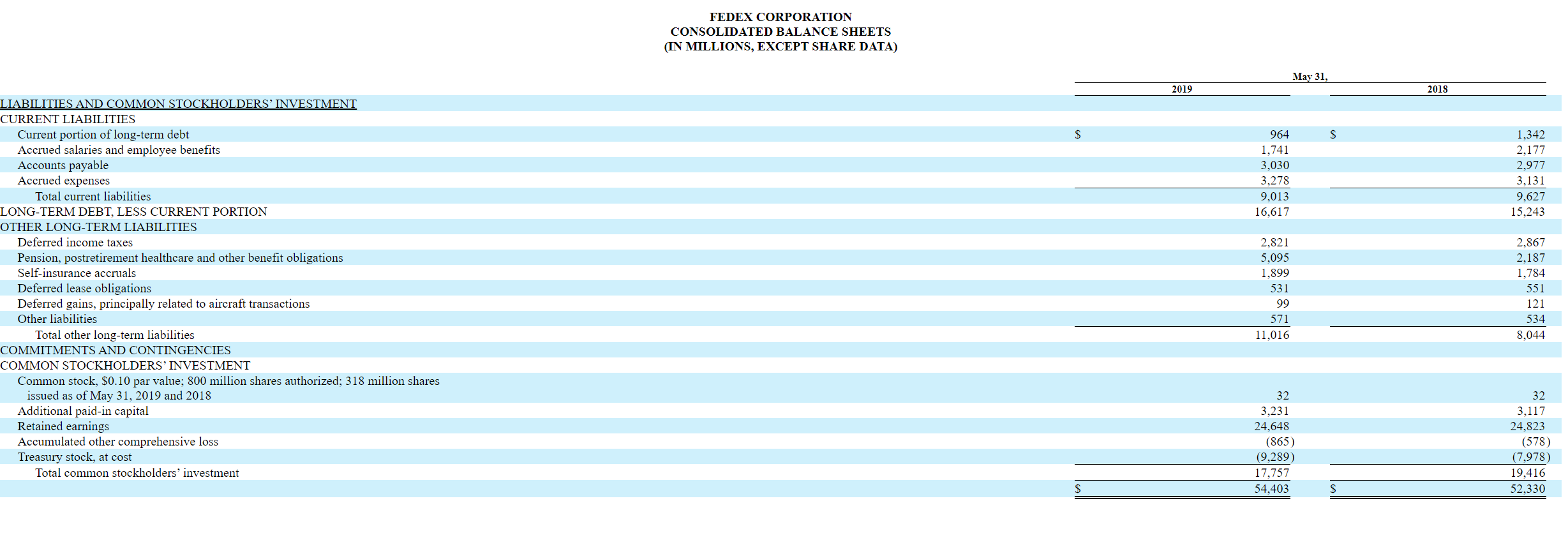

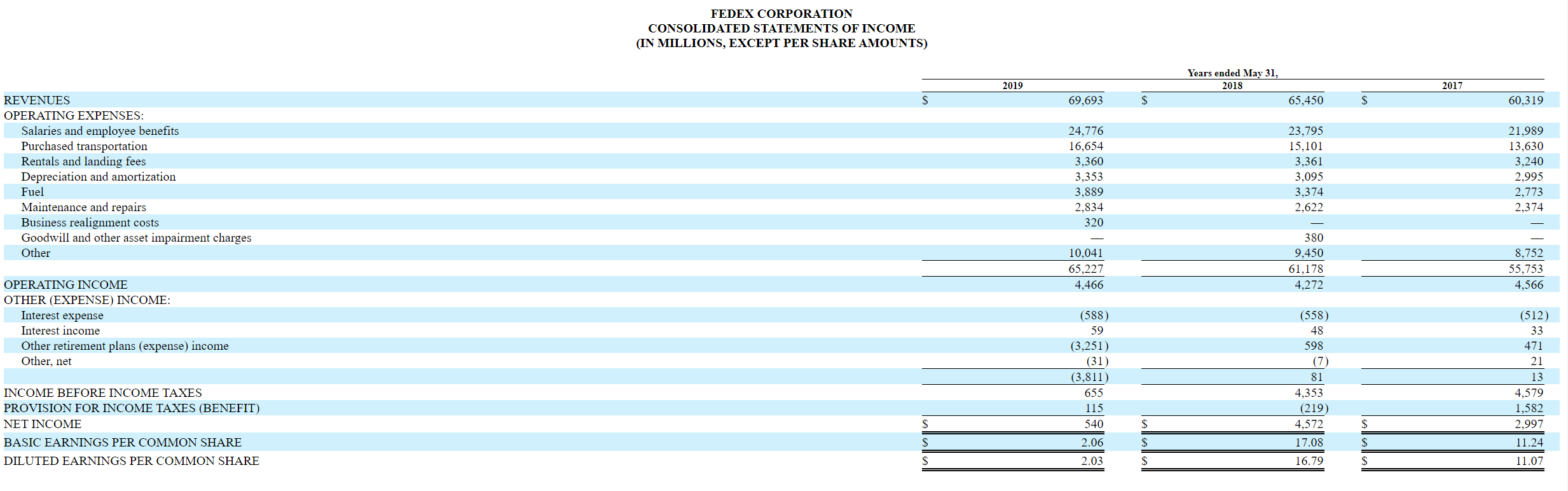

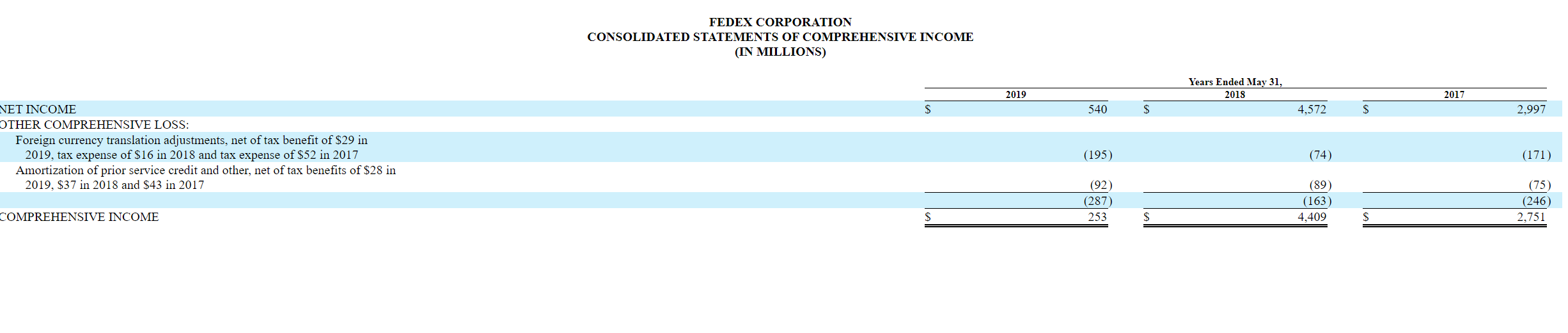

FEDEX CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS) May 31, 2019 2018 S $ ASSETS CURRENT ASSETS Cash and cash equivalents Receivables, less allowances of $300 and $401 Spare parts, supplies and fuel, less allowances of $335 and $268 Prepaid expenses and other Total current assets PROPERTY AND EQUIPMENT, AT COST Aircraft and related equipment Package handling and ground support equipment Information technology Vehicles and trailers Facilities and other 2,319 9.116 553 1,098 13,086 3,265 8,481 525 1,070 13,341 22,793 10,409 6.268 8,339 11,702 59,511 29,082 30,429 20,749 9,727 5,794 7,708 11.143 55,121 26,967 28,154 Less accumulated depreciation and amortization Net property and equipment OTHER LONG-TERM ASSETS Goodwill Other assets Total other long-term assets 6,884 4,004 10,888 54,403 6,973 3,862 10.835 52,330 S S FEDEX CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS, EXCEPT SHARE DATA) May 31, 2019 2018 S $ 964 1,741 3,030 3,278 9,013 16,617 1,342 2.177 2.977 3,131 9,627 15,243 LIABILITIES AND COMMON STOCKHOLDERS' INVESTMENT CURRENT LIABILITIES Current portion of long-term debt Accrued salaries and employee benefits Accounts payable Accrued expenses Total current liabilities LONG-TERM DEBT, LESS CURRENT PORTION OTHER LONG-TERM LIABILITIES Deferred income taxes Pension, postretirement healthcare and other benefit obligations Self-insurance accruals Deferred lease obligations Deferred gains, principally related to aircraft transactions Other liabilities Total other long-term liabilities COMMITMENTS AND CONTINGENCIES COMMON STOCKHOLDERS' INVESTMENT Common stock, $0.10 par value; 800 million shares authorized; 318 million shares issued as of May 31, 2019 and 2018 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost Total common stockholders' investment 2.821 5,095 1,899 531 99 2,867 2,187 1,784 551 121 534 8,044 571 11,016 32 3,231 24,648 (865) (9,289) 17,757 54,403 32 3,117 24,823 (578) (7,978) 19,416 52,330 S FEDEX CORPORATION CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS, EXCEPT PER SHARE AMOUNTS) Years ended May 31, 2018 2019 2017 $ 69,693 S 65,450 S 60,319 REVENUES OPERATING EXPENSES: Salaries and employee benefits Purchased transportation Rentals and landing fees Depreciation and amortization Fuel Maintenance and repairs Business realignment costs Goodwill and other asset impairment charges Other 24,776 16,654 3,360 3,353 3,889 2,834 320 23,795 15,101 3,361 3,095 3,374 2,622 21.989 13,630 3,240 2.995 2,773 2.374 10,041 65,227 4,466 380 9,450 61,178 4,272 8,752 55,753 4,566 OPERATING INCOME OTHER (EXPENSE) INCOME: Interest expense Interest income Other retirement plans (expense) income Other, net (588) 59 (3,251) (31) (3,811) 655 115 540 (558) 48 598 (7) 81 4,353 (219) 4,572 17.08 16.79 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES (BENEFIT) NET INCOME BASIC EARNINGS PER COMMON SHARE DILUTED EARNINGS PER COMMON SHARE (512) 33 471 21 13 4,579 1,582 2,997 11.24 11.07 S S S S 2.06 S S S 2.03 S S FEDEX CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (IN MILLIONS) Years Ended May 31, 2018 2019 2017 S 540 4,572 S 2,997 NET INCOME OTHER COMPREHENSIVE LOSS: Foreign currency translation adjustments, net of tax benefit of $29 in 2019, tax expense of $16 in 2018 and tax expense of $52 in 2017 Amortization of prior service credit and other, net of tax benefits of $28 in 2019, $37 in 2018 and $43 in 2017 (195) (74) (171) (92) (287 253 (89) (163) 4,409 (75) (246) 2,751 COMPREHENSIVE INCOME S FEDEX CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS) May 31, 2019 2018 S $ ASSETS CURRENT ASSETS Cash and cash equivalents Receivables, less allowances of $300 and $401 Spare parts, supplies and fuel, less allowances of $335 and $268 Prepaid expenses and other Total current assets PROPERTY AND EQUIPMENT, AT COST Aircraft and related equipment Package handling and ground support equipment Information technology Vehicles and trailers Facilities and other 2,319 9.116 553 1,098 13,086 3,265 8,481 525 1,070 13,341 22,793 10,409 6.268 8,339 11,702 59,511 29,082 30,429 20,749 9,727 5,794 7,708 11.143 55,121 26,967 28,154 Less accumulated depreciation and amortization Net property and equipment OTHER LONG-TERM ASSETS Goodwill Other assets Total other long-term assets 6,884 4,004 10,888 54,403 6,973 3,862 10.835 52,330 S S FEDEX CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS, EXCEPT SHARE DATA) May 31, 2019 2018 S $ 964 1,741 3,030 3,278 9,013 16,617 1,342 2.177 2.977 3,131 9,627 15,243 LIABILITIES AND COMMON STOCKHOLDERS' INVESTMENT CURRENT LIABILITIES Current portion of long-term debt Accrued salaries and employee benefits Accounts payable Accrued expenses Total current liabilities LONG-TERM DEBT, LESS CURRENT PORTION OTHER LONG-TERM LIABILITIES Deferred income taxes Pension, postretirement healthcare and other benefit obligations Self-insurance accruals Deferred lease obligations Deferred gains, principally related to aircraft transactions Other liabilities Total other long-term liabilities COMMITMENTS AND CONTINGENCIES COMMON STOCKHOLDERS' INVESTMENT Common stock, $0.10 par value; 800 million shares authorized; 318 million shares issued as of May 31, 2019 and 2018 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost Total common stockholders' investment 2.821 5,095 1,899 531 99 2,867 2,187 1,784 551 121 534 8,044 571 11,016 32 3,231 24,648 (865) (9,289) 17,757 54,403 32 3,117 24,823 (578) (7,978) 19,416 52,330 S FEDEX CORPORATION CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS, EXCEPT PER SHARE AMOUNTS) Years ended May 31, 2018 2019 2017 $ 69,693 S 65,450 S 60,319 REVENUES OPERATING EXPENSES: Salaries and employee benefits Purchased transportation Rentals and landing fees Depreciation and amortization Fuel Maintenance and repairs Business realignment costs Goodwill and other asset impairment charges Other 24,776 16,654 3,360 3,353 3,889 2,834 320 23,795 15,101 3,361 3,095 3,374 2,622 21.989 13,630 3,240 2.995 2,773 2.374 10,041 65,227 4,466 380 9,450 61,178 4,272 8,752 55,753 4,566 OPERATING INCOME OTHER (EXPENSE) INCOME: Interest expense Interest income Other retirement plans (expense) income Other, net (588) 59 (3,251) (31) (3,811) 655 115 540 (558) 48 598 (7) 81 4,353 (219) 4,572 17.08 16.79 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES (BENEFIT) NET INCOME BASIC EARNINGS PER COMMON SHARE DILUTED EARNINGS PER COMMON SHARE (512) 33 471 21 13 4,579 1,582 2,997 11.24 11.07 S S S S 2.06 S S S 2.03 S S FEDEX CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (IN MILLIONS) Years Ended May 31, 2018 2019 2017 S 540 4,572 S 2,997 NET INCOME OTHER COMPREHENSIVE LOSS: Foreign currency translation adjustments, net of tax benefit of $29 in 2019, tax expense of $16 in 2018 and tax expense of $52 in 2017 Amortization of prior service credit and other, net of tax benefits of $28 in 2019, $37 in 2018 and $43 in 2017 (195) (74) (171) (92) (287 253 (89) (163) 4,409 (75) (246) 2,751 COMPREHENSIVE INCOME S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts