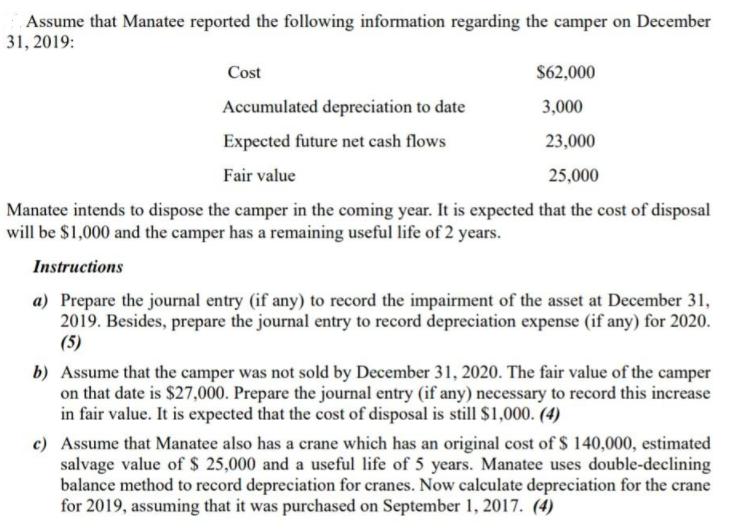

Question: Assume that Manatee reported the following information regarding the camper on December 31, 2019: Cost $62,000 Accumulated depreciation to date 3,000 Expected future net

Assume that Manatee reported the following information regarding the camper on December 31, 2019: Cost $62,000 Accumulated depreciation to date 3,000 Expected future net cash flows 23,000 Fair value 25,000 Manatee intends to dispose the camper in the coming year. It is expected that the cost of disposal will be $1,000 and the camper has a remaining useful life of 2 years. Instructions a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2019. Besides, prepare the journal entry to record depreciation expense (if any) for 2020. (5) b) Assume that the camper was not sold by December 31, 2020. The fair value of the camper on that date is $27,000. Prepare the journal entry (if any) necessary to record this increase in fair value. It is expected that the cost of disposal is still $1,000. (4) c) Assume that Manatee also has a crane which has an original cost of $ 140,000, estimated salvage value of S 25,000 and a useful life of 5 years. Manatee uses double-declining balance method to record depreciation for cranes. Now calculate depreciation for the crane for 2019, assuming that it was purchased on September 1, 2017. (4)

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

a Journal entries i Impairment loss Date Account Debit Credit Dec 312019 Impairment loss 35000 Asset ... View full answer

Get step-by-step solutions from verified subject matter experts