Question: Assume that on January 1 , Eclipse Corp. received a five - month, $ 1 0 , 0 0 0 zero - interest - bearing

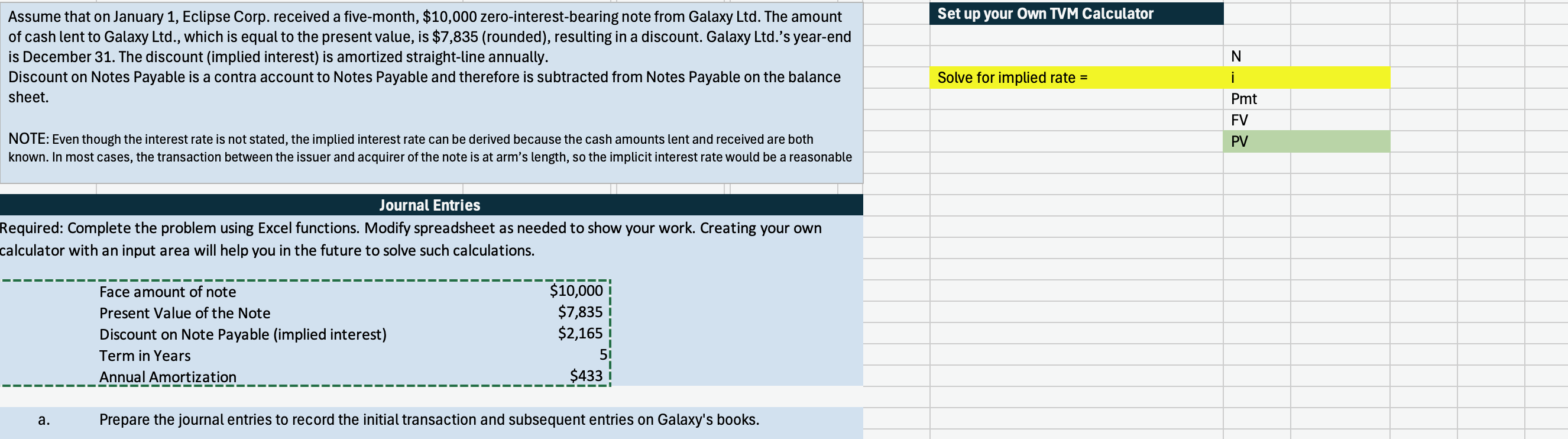

Assume that on January Eclipse Corp. received a fivemonth, $ zerointerestbearing note from Galaxy Ltd The amount

of cash lent to Galaxy Ltd which is equal to the present value, is $rounded resulting in a discount. Galaxy Ltds yearend

is December The discount implied interest is amortized straightline annually.

Discount on Notes Payable is a contra account to Notes Payable and therefore is subtracted from Notes Payable on the balance

sheet.

NOTE: Even though the interest rate is not stated, the implied interest rate can be derived because the cash amounts lent and received are both

known. In most cases, the transaction between the issuer and acquirer of the note is at arm's length, so the implicit interest rate would be a reasonable

a Prepare the journal entries to record the initial

transaction and subsequent entries on Galaxy's books.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock