Question: Assume that on October 1, a note which has a face value of $2,000, bears interest at 6 percent for 90 days, received from a

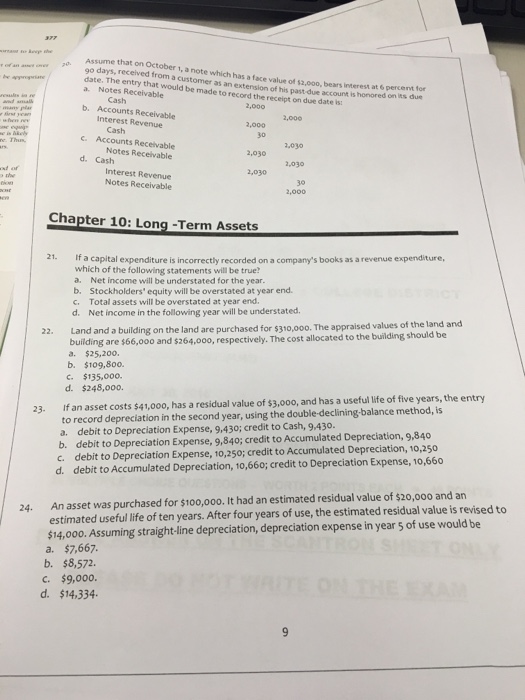

Assume that on October 1, a note which has a face value of $2,000, bears interest at 6 percent for 90 days, received from a customer as an extension of his past-due account is honored on its due date. The entry that would be made to record the receipt on due date is: If a capital expenditure is incorrectly recorded on a company's books as a revenue expenditure, which of the following statements will be true? Net income will be understated for the year. Stockholders' equity will be overstated at year end Total assets will be overstated at year end. Net income in the following year will be understated. Land and a building on the land are purchased for $310,000 The appraised values of the land and building are $66,000 and $264,000, respectively. The cost allocated to the building should be $25, 200. $109, 800. $135,000. $248,000. If an asset costs $41,000, has a residual value of $3,000. and has a useful life of five years, the entry to record depreciation in the second year, using the double-declining-balance method is, debit to Depreciation Expense, 9, 430; credit to Cash, 9, 430 debit to Depreciation Expense, 9, 840; credit to Accumulated Depreciation. 9, 840 debit to Depreciation Expense, 10, 250; credit to Accumulated Depreciation, 10, 250 debit to Accumulated Depreciation, 10, 660; credit to Depreciation Expense, 10, 660 An asset was purchased for $100,000. It had an estimated residual value of $20,000 and an estimated useful life of ten years. After four years of use, the estimated residual value is revised to $14,000. Assuming straight-line depreciation, depreciation expense in year 5 of use would be $7, 667. $8, 572. $9,000. $14, 334

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts