Question: assume that Securization combined with borrowing and irrational exuberance in hyperville have driven up the value of existing financial securities at geometric rate, specifically from

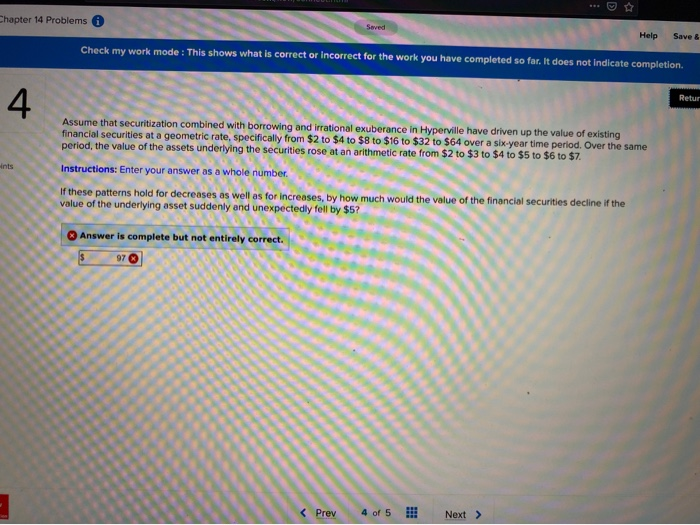

hapter 14 Problems Help Save & Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Assume that securitization combined with borrowing and irrational exuberance in Hyperville have driven up the value of existing financial securities at a geometric rate, specifically from $2 to $4 to $8 to $16 to $32 to $64 over a six-year time period. Over the same period, the value of the assets underlying the securities rose at an arithmetic rate from $2 to $3 to $4 to $5 to $6 to $7. Instructions: Enter your answer as a whole number. If these patterns hold for decreases as well as for increases, by how much would the value of the financial securities decline if the value of the underlying asset suddenly and unexpectedly fell by $5? Answer is complete but not entirely correct. 3221 !!! Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts