Question: Assume that Sharp operates in an industry for which NOL carryback is allowed. In its first three years of operations Sharp reported the following

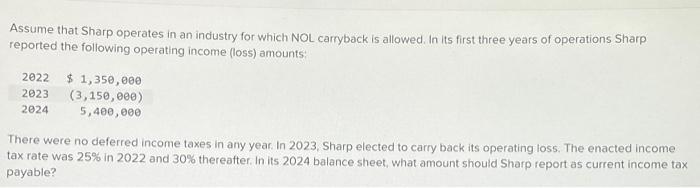

Assume that Sharp operates in an industry for which NOL carryback is allowed. In its first three years of operations Sharp reported the following operating income (loss) amounts: 2022 $ 1,350,000 2023 2024 (3,150,000) 5,400,000 There were no deferred income taxes in any year. In 2023, Sharp elected to carry back its operating loss. The enacted income tax rate was 25% in 2022 and 30% thereafter. In its 2024 balance sheet, what amount should Sharp report as current income tax payable?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock