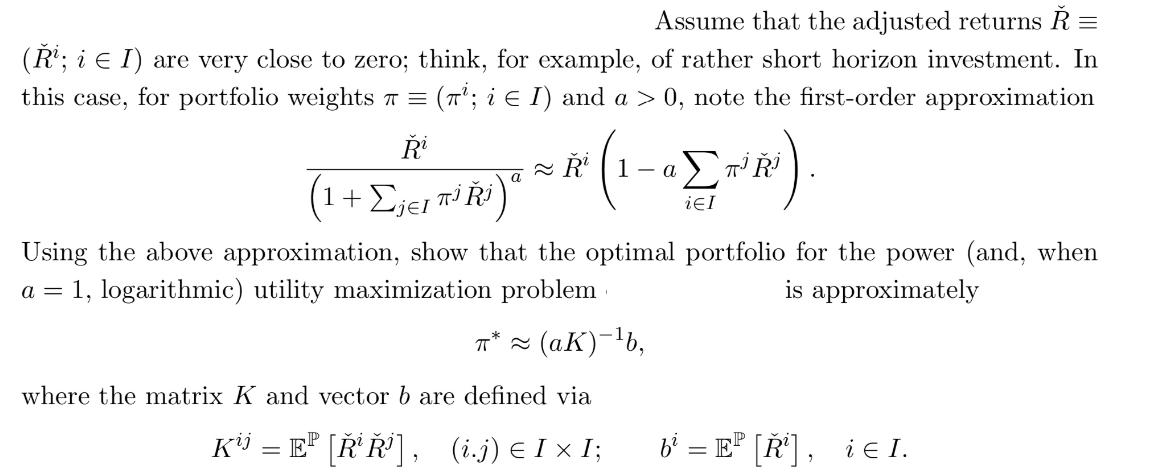

Question: = Assume that the adjusted returns (; i = I) are very close to zero; think, for example, of rather short horizon investment. In

= Assume that the adjusted returns (; i = I) are very close to zero; think, for example, of rather short horizon investment. In this case, for portfolio weights = (7; i = I) and a > 0, note the first-order approximation i (1 + Ejel Ti i)" *(1-a [~R). Using the above approximation, show that the optimal portfolio for the power (and, when = 1, logarithmic) utility maximization problem is approximately a = * (aK)-b, where the matrix K and vector b are defined via K = EP [ ], (i.j) = I x I; b = EP[R], ie I.

Step by Step Solution

3.58 Rating (159 Votes )

There are 3 Steps involved in it

The power utility portfolio optimization problem can be w... View full answer

Get step-by-step solutions from verified subject matter experts