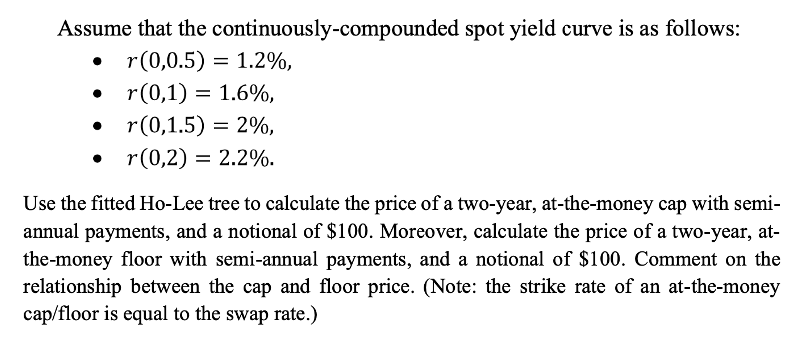

Question: . Assume that the continuously-compounded spot yield curve is as follows: r(0,0.5) = 1.2%, r(0,1) = 1.6%, r(0,1.5) = 2%, r(0,2) = 2.2%. Use the

. Assume that the continuously-compounded spot yield curve is as follows: r(0,0.5) = 1.2%, r(0,1) = 1.6%, r(0,1.5) = 2%, r(0,2) = 2.2%. Use the fitted Ho-Lee tree to calculate the price of a two-year, at-the-money cap with semi- annual payments, and a notional of $100. Moreover, calculate the price of a two-year, at- the-money floor with semi-annual payments, and a notional of $100. Comment on the relationship between the cap and floor price. (Note: the strike rate of an at-the- money cap/floor is equal to the swap rate.) . Assume that the continuously-compounded spot yield curve is as follows: r(0,0.5) = 1.2%, r(0,1) = 1.6%, r(0,1.5) = 2%, r(0,2) = 2.2%. Use the fitted Ho-Lee tree to calculate the price of a two-year, at-the-money cap with semi- annual payments, and a notional of $100. Moreover, calculate the price of a two-year, at- the-money floor with semi-annual payments, and a notional of $100. Comment on the relationship between the cap and floor price. (Note: the strike rate of an at-the- money cap/floor is equal to the swap rate.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts