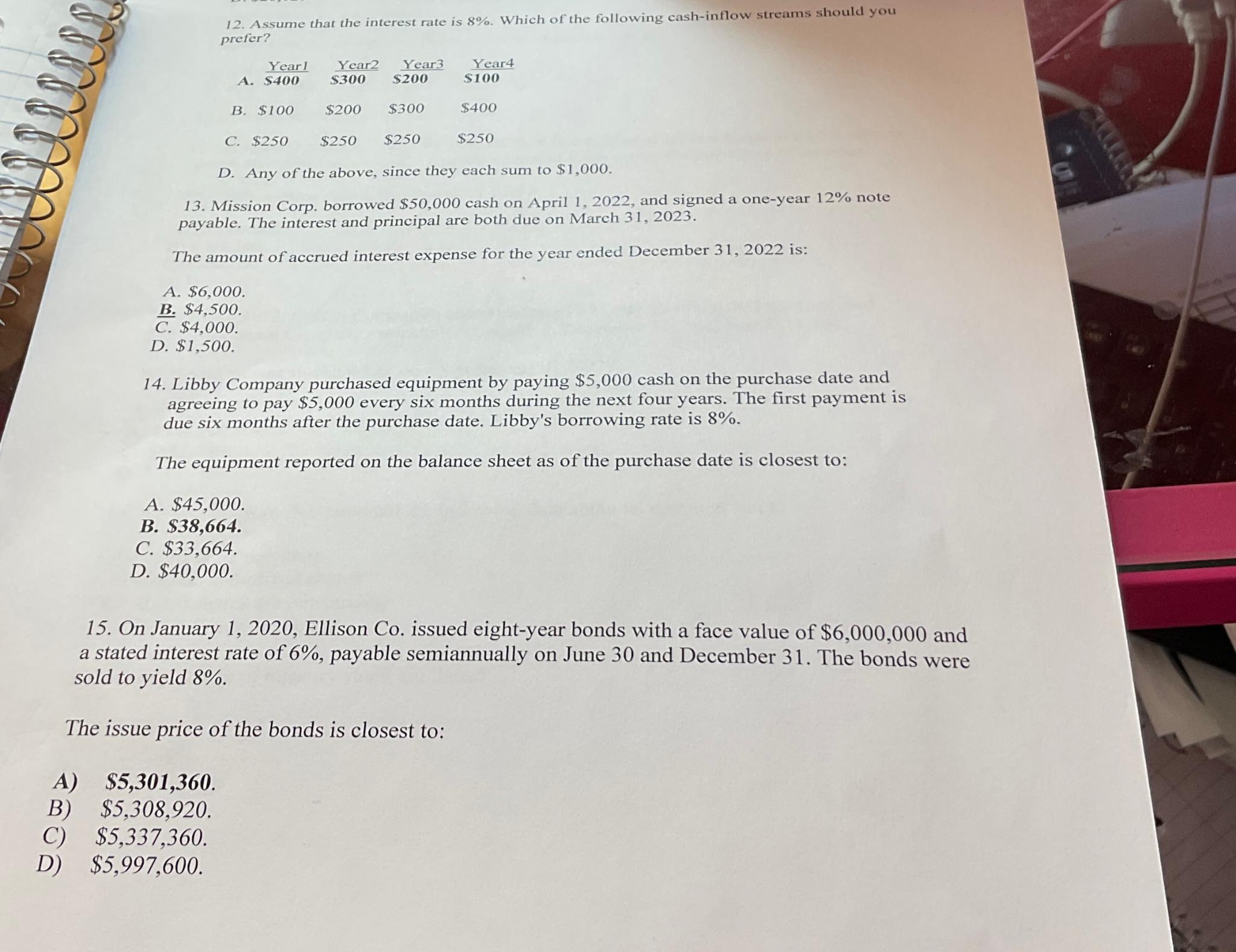

Question: Assume that the interest rate is 8 % . Which of the following cash - inflow streams should you prefer? A . Y e a

Assume that the interest rate is Which of the following cashinflow streams should you prefer?

A

B $$$$

C $$$$

D Any of the above, since they each sum to $

Mission Corp. borrowed $ cash on April and signed a oneyear note payable. The interest and principal are both due on March

The amount of accrued interest expense for the year ended December is:

A $

B $

C $

D $

Libby Company purchased equipment by paying $ cash on the purchase date and agreeing to pay $ every six months during the next four years. The first payment is due six months after the purchase date. Libby's borrowing rate is

The equipment reported on the balance sheet as of the purchase date is closest to:

A $

B $

C $

D $

On January Ellison Co issued eightyear bonds with a face value of $ and a stated interest rate of payable semiannually on June and December The bonds were sold to yield

The issue price of the bonds is closest to:

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock