Question: Assume that the Section 179 deduction limit is $1,000,000 and that businesses exceeding a total of $2,500,000 in purchases of qualifying personal property will have

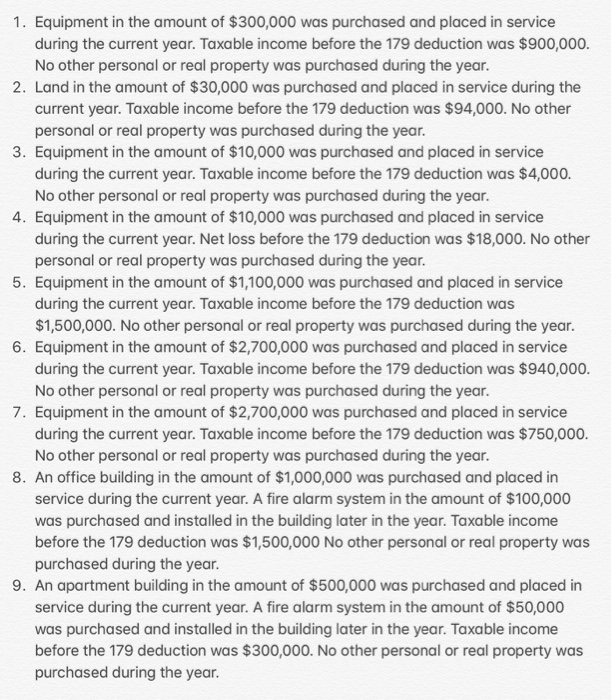

Assume that the Section 179 deduction limit is $1,000,000 and that businesses exceeding a total of $2,500,000 in purchases of qualifying personal property will have the Section 179 deduction phase-out dollar-for-dollar. Also assume that the taxpayer has elected out of any bonus depreciation. Please treat each item separately.

1. Equipment in the amount of $300,000 was purchased and placed in service during the current year. Taxable income before the 179 deduction was $900,000. No other personal or real property was purchased during the year 2. Land in the amount of $30,000 was purchased and placed in service during the current year. Taxable income before the 179 deduction was $94,000. No other personal or real property was purchased during the year. 3. Equipment in the amount of $10,000 was purchased and placed in service during the current year. Taxable income before the 179 deduction was $4,000. No other personal or real property was purchased during the year 4. Equipment in the amount of $10,000 was purchased and placed in service during the current year. Net loss before the 179 deduction was $18,000. No other personal or real property was purchased during the year. 5. Equipment in the amount of $1,100,000 was purchased and placed in service during the current year. Taxable income before the 179 deduction was $1,500,000. No other personal or real property was purchased during the year 6. Equipment in the amount of $2,700,000 was purchased and placed in service during the current year. Taxable income before the 179 deduction was $940,000. No other personal or real property was purchased during the year 7. Equipment in the amount of $2,700,000 was purchased and placed in service during the current year. Taxable income before the 179 deduction was $750,000. No other personal or real property was purchased during the year 8. An office building in the amount of $1,000,000 was purchased and placed in service during the current year. A fire alarm system in the amount of $100,000 was purchased and installed in the building later in the year. Taxable income before the 179 deduction was $1,500,000 No other personal or real property was purchased during the year. 9. An apartment building in the amount of $500,000 was purchased and placed in service during the current year. A fire alarm system in the amount of $50,000 was purchased and installed in the building later in the year. Taxable income before the 179 deduction was $300,000. No other personal or real property was purchased during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts