Question: Assume that this company is also considering a third project C, which requires an initial investment of 225,000 and expects to generate annual net cash

Assume that this company is also considering a third project C, which requires an initial investment of 225,000 and expects to generate annual net cash flows of 25,000 in perpetuity. These cash flows are adjusted for the expected annual inflation rate of 2%. Suggest whether the company should undertake project C given that companys cost of capital (9%) is not adjusted for inflation.

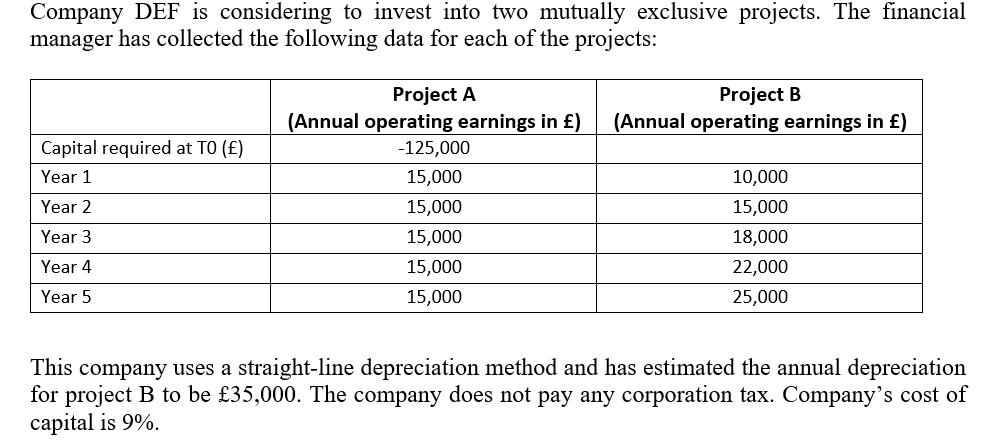

Company DEF is considering to invest into two mutually exclusive projects. The financial manager has collected the following data for each of the projects: This company uses a straight-line depreciation method and has estimated the annual depreciation for project B to be 35,000. The company does not pay any corporation tax. Company's cost of capital is 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts