Question: Assume that you hold a portfolio that involves only positions in three mutual funds (A, B, and C): Mutual Fund A B C Assume that:

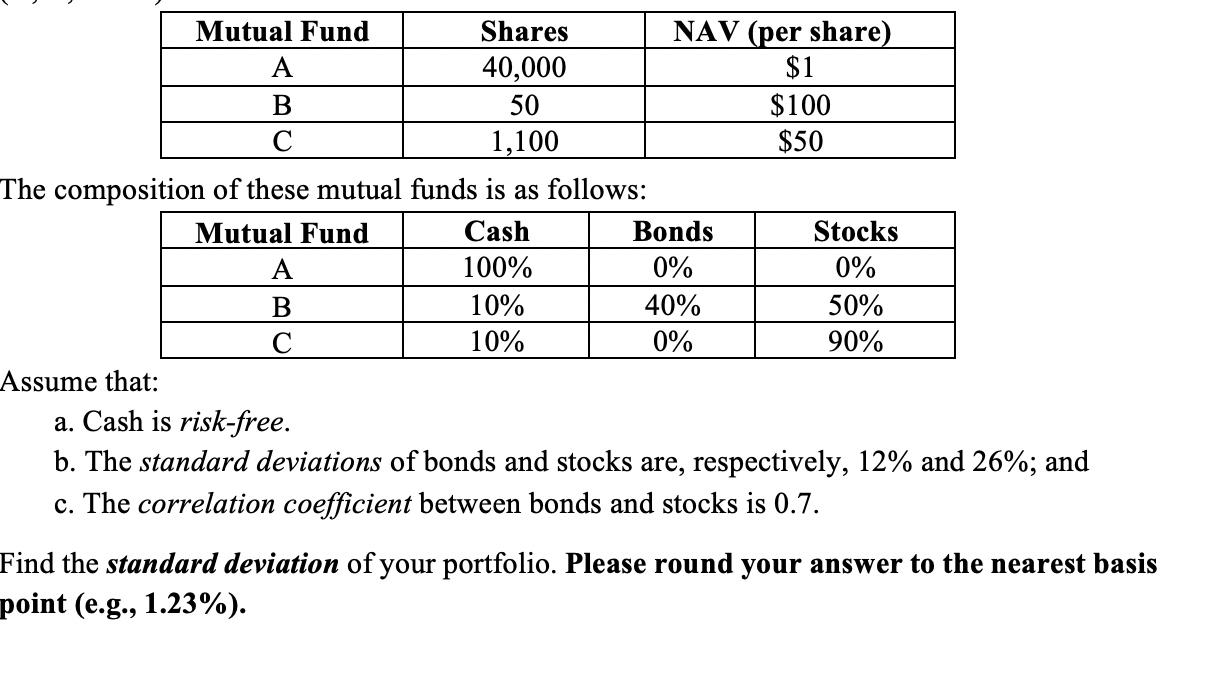

Assume that you hold a portfolio that involves only positions in threemutual funds (A, B, and C):

Mutual Fund A B C Assume that: The composition of these mutual funds is as follows: Mutual Fund Cash 100% 10% 10% Shares 40,000 50 1,100 A B C NAV (per share) $1 $100 $50 Bonds 0% 40% 0% Stocks 0% 50% 90% a. Cash is risk-free. b. The standard deviations of bonds and stocks are, respectively, 12% and 26% and c. The correlation coefficient between bonds and stocks is 0.7. Find the standard deviation of your portfolio. Please round your answer to the nearest basis point (e.g., 1.23%).

Step by Step Solution

There are 3 Steps involved in it

ANSWER To find the standard deviation of the portfolio we first need to calculate the weights of eac... View full answer

Get step-by-step solutions from verified subject matter experts