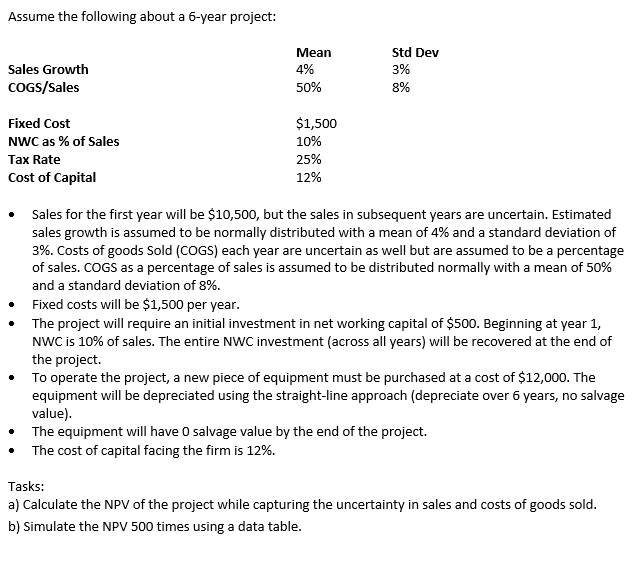

Question: Assume the following about a 5-year project: Std Dev Mean 4% 50% Sales Growth COGS/Sales 3% 8% Fixed Cost NWC as % of Sales Tax

Assume the following about a 5-year project: Std Dev Mean 4% 50% Sales Growth COGS/Sales 3% 8% Fixed Cost NWC as % of Sales Tax Rate Cost of Capital $1,500 10% 25% 12% Sales for the first year will be $10,500, but the sales in subsequent years are uncertain. Estimated sales growth is assumed to be normally distributed with a mean of 4% and a standard deviation of 3%. Costs of goods Sold (COGS) each year are uncertain as well but are assumed to be a percentage of sales. COGS as a percentage of sales is assumed to be distributed normally with a mean of 50% and a standard deviation of 8%. Fixed costs will be $1,500 per year. The project will require an initial investment in net working capital of $500. Beginning at year 1, NWC is 10% of sales. The entire NWC investment (across all years) will be recovered at the end of the project. To operate the project, a new piece of equipment must be purchased at a cost of $12,000. The equipment will be depreciated using the straight-line approach (depreciate over 6 years, no salvage value). The equipment will have 0 salvage value by the end of the project. The cost of capital facing the firm is 12%. Tasks: a) Calculate the NPV of the project while capturing the uncertainty in sales and costs of goods sold. b) Simulate the NPV 500 times using a data table. Assume the following about a 5-year project: Std Dev Mean 4% 50% Sales Growth COGS/Sales 3% 8% Fixed Cost NWC as % of Sales Tax Rate Cost of Capital $1,500 10% 25% 12% Sales for the first year will be $10,500, but the sales in subsequent years are uncertain. Estimated sales growth is assumed to be normally distributed with a mean of 4% and a standard deviation of 3%. Costs of goods Sold (COGS) each year are uncertain as well but are assumed to be a percentage of sales. COGS as a percentage of sales is assumed to be distributed normally with a mean of 50% and a standard deviation of 8%. Fixed costs will be $1,500 per year. The project will require an initial investment in net working capital of $500. Beginning at year 1, NWC is 10% of sales. The entire NWC investment (across all years) will be recovered at the end of the project. To operate the project, a new piece of equipment must be purchased at a cost of $12,000. The equipment will be depreciated using the straight-line approach (depreciate over 6 years, no salvage value). The equipment will have 0 salvage value by the end of the project. The cost of capital facing the firm is 12%. Tasks: a) Calculate the NPV of the project while capturing the uncertainty in sales and costs of goods sold. b) Simulate the NPV 500 times using a data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts