Question: Assume the one period binomial model with initial share price 400, up and down factors = 1.25, d = 0.9 and interest compounded at

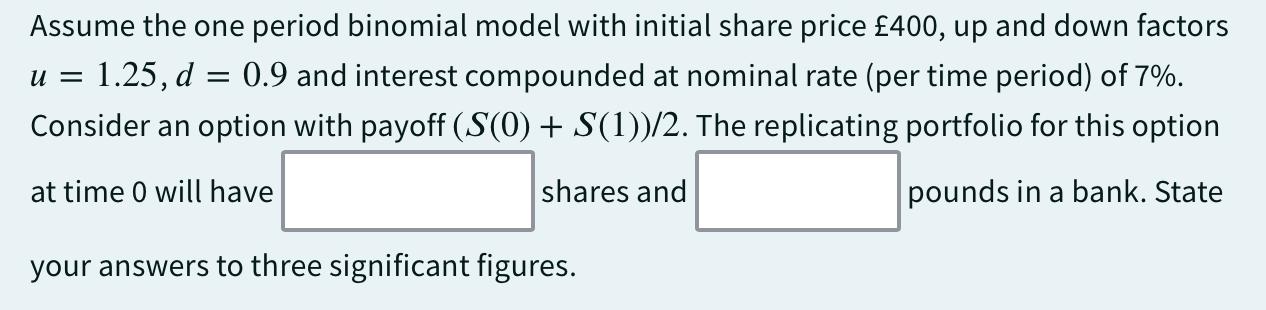

Assume the one period binomial model with initial share price 400, up and down factors = 1.25, d = 0.9 and interest compounded at nominal rate (per time period) of 7%. Consider an option with payoff (S(0) + S(1))/2. The replicating portfolio for this option u = at time 0 will have shares and pounds in a bank. State your answers to three significant figures.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

The replicating portfolio for the option will have 200 shares and 200 in the bank Heres how we can a... View full answer

Get step-by-step solutions from verified subject matter experts