Question: Assume the same situation as in Question 2. After the shock, the government wants to act. The President asks for advice from two different groups

Assume the same situation as in Question 2. After the shock, the government wants to act. The President asks for advice from two different groups of economists: Freshwaters and NewKeynesians

a) Freshwater economists are often advocates of the Real Business Cycle theory. In this theory, prices are flexible. According to this group, would an expansionist monetary policy be effective in recovering the economy? Explain with words. (You do not need to provide graphs here.)

Rubric: Yes or no? (3 points). Explanation. (9 points).

b) New-Keynesians believe that prices are fixed in the short-run. Use graphs of the NewKeynesian model with sticky prices to show the effect of an expansionist monetary policy, i.e., a decline in the target real interest rate. Would a New-Keynesian economist agree that monetary policy helps the economy to recover? Explain with words.

Rubric: Assume that the economy is initially in equilibrium. Draw all the four graphs utilized in the lecture videos to represent the New-Keynesian model. Make sure to label the axes (3 points). First, show how the expansionist monetary policy takes place in the money market (2 points). Then, show the effect on the output market. Does output increase or decrease? (2 points). How is the change in output accommodated in the labor market? What happens with employment and wages? (2 points). Would a New-Keynesian economist agree that monetary policy helps the economy to recover? Yes or no? (1 point). Briefly explain why, based on the graphs. (2 points).

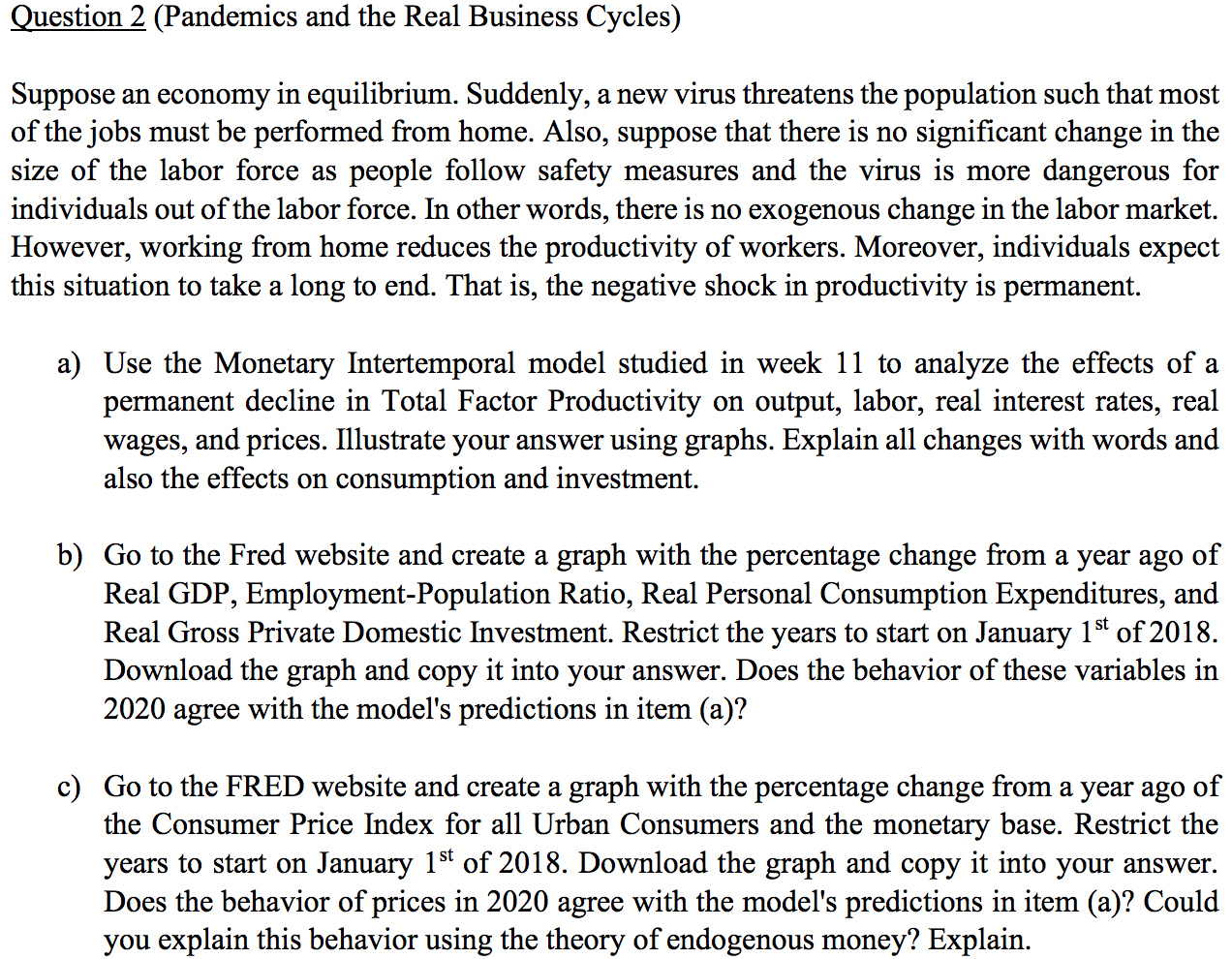

Question 2 (Pandemics and the Real Business Cycles) Suppose an economy in equilibrium. Suddenly, a new virus threatens the population such that most of the jobs must be performed from home. Also, suppose that there is no signicant change in the size of the labor force as people follow safety measures and the virus is more dangerous for individuals out of the labor force. In other words, there is no exogenous change in the labor market. However, working from home reduces the productivity of workers. Moreover, individuals expect this situation to take a long to end. That is, the negative shock in productivity is permanent. a) Use the Monetary Intertemporal model studied in week 11 to analyze the effects of a permanent decline in Total Factor Productivity on output, labor, real interest rates, real wages, and prices. Illustrate your answer using graphs. Explain all changes with words and also the effects on consumption and investment. b) Go to the Fred website and create a graph with the percentage change from a year ago of Real GDP, Employment-Population Ratio, Real Personal Consumption Expenditures, and Real Gross Private Domestic Investment. Restrict the years to start on January lSt of 2018. Download the graph and copy it into your answer. Does the behavior of these variables in 2020 agree with the model's predictions in item (a)? c) Go to the FRED website and create a graph with the percentage change from a year ago of the Consumer Price Index for all Urban Consumers and the monetary base. Restrict the years to start on January 1St of 2018. Download the graph and copy it into your answer. Does the behavior of prices in 2020 agree with the model's predictions in item (a)? Could you explain this behavior using the theory of endogenous money? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts