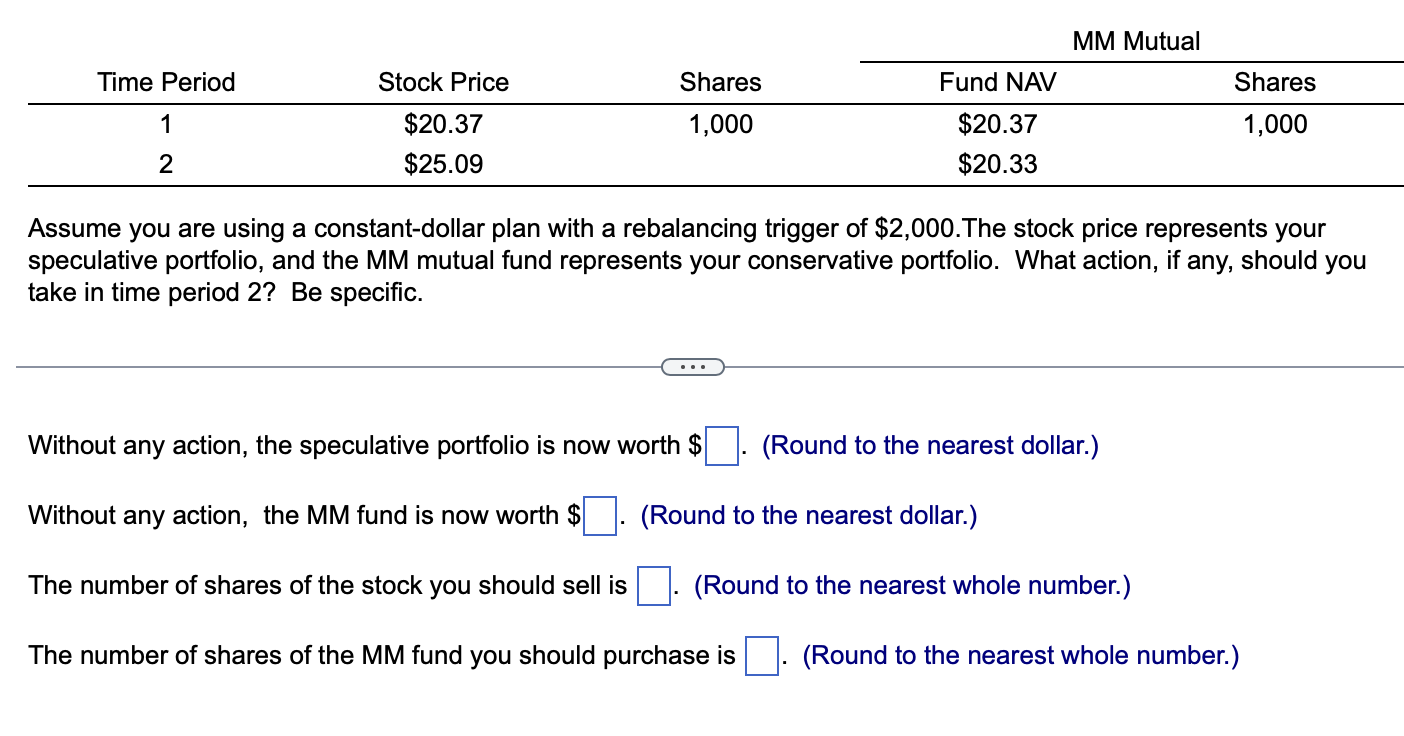

Question: Assume you are using a constant - dollar plan with a rebalancing trigger of $ 2 , 0 0 0 . The stock price represents

Assume you are using a constantdollar plan with a rebalancing trigger of $ The stock price represents your

speculative portfolio, and the MM mutual fund represents your conservative portfolio. What action, if any, should you

take in time period Be specific.

Without any action, the speculative portfolio is now worth $ Round to the nearest dollar.

Without any action, the MM fund is now worth $ Round to the nearest dollar.

The number of shares of the stock you should sell is Round to the nearest whole number.

The number of shares of the MM fund you should purchase is Round to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock