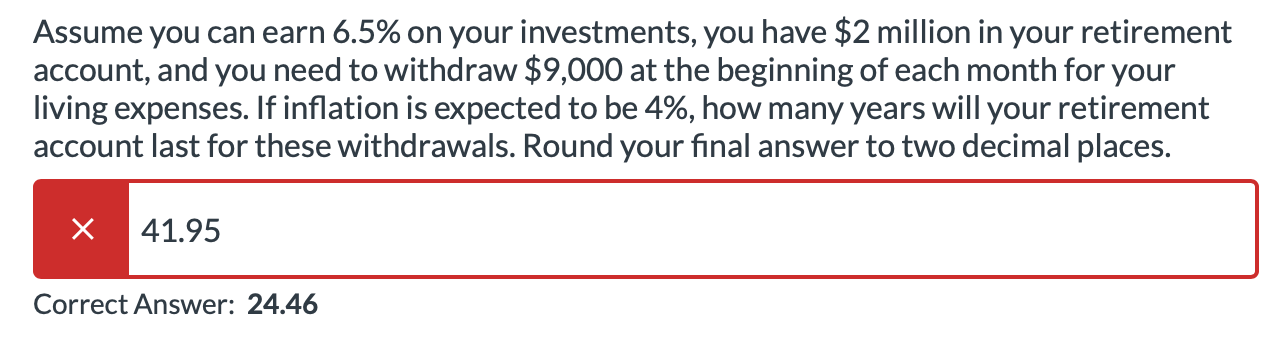

Question: Assume you can earn 6 . 5 % on your investments, you have ( $ 2 ) million in your retirement

Assume you can earn on your investments, you have $ million in your retirement account, and you need to withdraw $ at the beginning of each month for your living expenses. If inflation is expected to be how many years will your retirement account last for these withdrawals. Round your final answer to two decimal places.

Correct Answer:

CORRECT ANSWER IS SHOW THE WORK TO EXPLAIN HOW THIS IS THE CORRECT ANSWER. DO NOT ALLOW ANY OTHER ANSWER TO BE CORRECT

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock