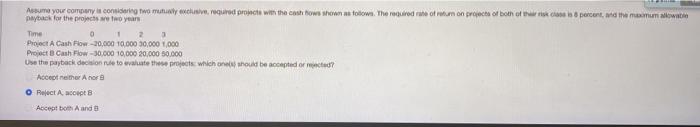

Question: Assume your company is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of

Asume your company considering two muy exclusive, regured recte win the cash rows shown in totown. The rendredte om on project of both of their roku o percent, mammadowicie payback for the projects to years Time 0 Project A Cash Flow -30,000 10.000 30,000 1,000 Project Cash Flow - 30,000 10,000 20,000 50.000 Use the payback decide to what there which one should be comptador Accept the Anora Relect Ascot Accept A and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts