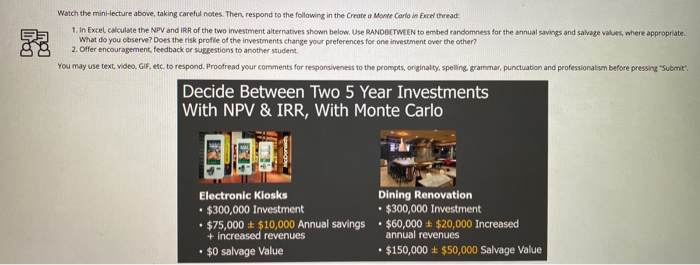

Question: assuming 5% rate Module 06 Forum: Create a Monte Carlo in Excel Watch the mini-lecture above, taking careful notes. Then, respond to the following in

Module 06 Forum: Create a Monte Carlo in Excel Watch the mini-lecture above, taking careful notes. Then, respond to the following in the Create a Monte Carlo in Excel thread: 1. In Excel, calculate the NPV and IRR of the two investment alternatives shown below. Use RANDBETWEEN to embed randomness for the annual savings and salvage values, where appropriate What do you observe? Does the risk profile of the investments change your preferences for one investment over the other? 2. Offer encouragement feedback or suggestions to another student You may use text, video, GIF, etc. to respond. Proofread your comments for responsiveness to the prompts, originality, speling grammar, punctuation and professionalism before pressing "Submit". Decide Between Two 5 Year Investments With NPV & IRR, With Monte Carlo Electronic Kiosks $300,000 Investment $75,000 $10,000 Annual savings + increased revenues $0 salvage Value Dining Renovation $300,000 Investment $60,000 $20,000 Increased annual revenues $150,000 $50,000 Salvage Value Watch the mini-lecture above, taking careful notes. Then, respond to the following in the Create a Monte Carlo in Excel thread 1. In Excel, calculate the NPV and IRR of the two investment alternatives shown below. Use RANDBETWEEN to embed randomness for the annual savings and salvage values, where appropriate What do you observe? Does the risk profile of the investments change your preferences for one investment over the other? 2. Offer encouragement feedback or suggestions to another student You may use text, video, GIF, etc. to respond. Proofread your comments for responsiveness to the prompts, originalty, spelling, grammar, punctuation and professionalism before pressing "submit". Decide Between Two 5 Year Investments With NPV & IRR, With Monte Carlo Electronic Kiosks Dining Renovation $300,000 Investment $300,000 Investment $75,000 - $10,000 Annual savings $60,000 $20,000 Increased + increased revenues . $0 salvage Value $150,000 + $50,000 Salvage Value annual revenues Module 06 Forum: Create a Monte Carlo in Excel Watch the mini-lecture above, taking careful notes. Then, respond to the following in the Create a Monte Carlo in Excel thread: 1. In Excel, calculate the NPV and IRR of the two investment alternatives shown below. Use RANDBETWEEN to embed randomness for the annual savings and salvage values, where appropriate What do you observe? Does the risk profile of the investments change your preferences for one investment over the other? 2. Offer encouragement feedback or suggestions to another student You may use text, video, GIF, etc. to respond. Proofread your comments for responsiveness to the prompts, originality, speling grammar, punctuation and professionalism before pressing "Submit". Decide Between Two 5 Year Investments With NPV & IRR, With Monte Carlo Electronic Kiosks $300,000 Investment $75,000 $10,000 Annual savings + increased revenues $0 salvage Value Dining Renovation $300,000 Investment $60,000 $20,000 Increased annual revenues $150,000 $50,000 Salvage Value Watch the mini-lecture above, taking careful notes. Then, respond to the following in the Create a Monte Carlo in Excel thread 1. In Excel, calculate the NPV and IRR of the two investment alternatives shown below. Use RANDBETWEEN to embed randomness for the annual savings and salvage values, where appropriate What do you observe? Does the risk profile of the investments change your preferences for one investment over the other? 2. Offer encouragement feedback or suggestions to another student You may use text, video, GIF, etc. to respond. Proofread your comments for responsiveness to the prompts, originalty, spelling, grammar, punctuation and professionalism before pressing "submit". Decide Between Two 5 Year Investments With NPV & IRR, With Monte Carlo Electronic Kiosks Dining Renovation $300,000 Investment $300,000 Investment $75,000 - $10,000 Annual savings $60,000 $20,000 Increased + increased revenues . $0 salvage Value $150,000 + $50,000 Salvage Value annual revenues

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts