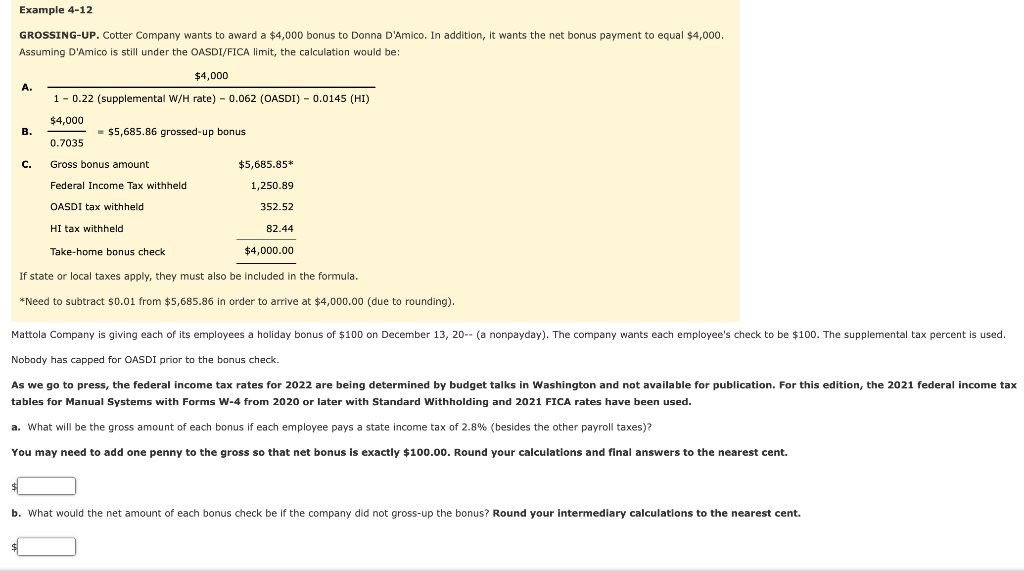

Question: Assuming D'Amico is still under the OASDI/FICA limit, the calculation would be: If state or local taxes apply, they must also be included in the

Assuming D'Amico is still under the OASDI/FICA limit, the calculation would be: If state or local taxes apply, they must also be included in the formula. *Need to subtract $0.01 from $5,685.86 in order to arrive at $4,000.00 (due to rounding). Nobody has capped for OASDI prior to the bonus check. tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2021 FICA rates have been used. a. What will be the gross amount of each bonus if each employee pays a state income tax of 2.8% (besides the other payroll taxes)? You may need to add one penny to the gross so that net bonus is exactly $100.00. Round your calculations and final answers to the nearest cent. b. What would the net amount of each bonus check be if the company did not gross-up the bonus? Round your intermediary calculations to the nearest cent. q. Assuming D'Amico is still under the OASDI/FICA limit, the calculation would be: If state or local taxes apply, they must also be included in the formula. *Need to subtract $0.01 from $5,685.86 in order to arrive at $4,000.00 (due to rounding). Nobody has capped for OASDI prior to the bonus check. tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2021 FICA rates have been used. a. What will be the gross amount of each bonus if each employee pays a state income tax of 2.8% (besides the other payroll taxes)? You may need to add one penny to the gross so that net bonus is exactly $100.00. Round your calculations and final answers to the nearest cent. b. What would the net amount of each bonus check be if the company did not gross-up the bonus? Round your intermediary calculations to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts