Question: Assuming purchase costs are declining, determine which statements below correctly describe what happens to cost of goods sold under FIFO, LIFO and weighted average cost

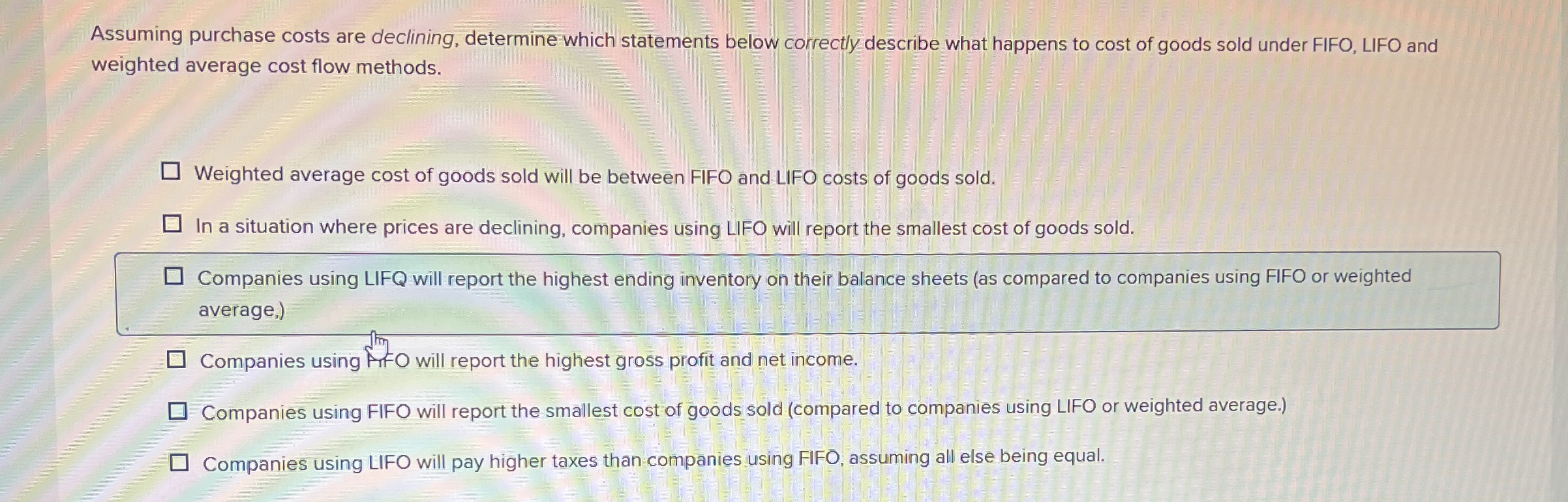

Assuming purchase costs are declining, determine which statements below correctly describe what happens to cost of goods sold under FIFO, LIFO and

weighted average cost flow methods.

Weighted average cost of goods sold will be between FIFO and LIFO costs of goods sold.

In a situation where prices are declining, companies using LIFO will report the smallest cost of goods sold.

Companies using LIFQ will report the highest ending inventory on their balance sheets as compared to companies using FIFO or weighted

average,

Companies using frFO will report the highest gross profit and net income.

Companies using FIFO will report the smallest cost of goods sold compared to companies using LIFO or weighted average.

Companies using LIFO will pay higher taxes than companies using FIFO, assuming all else being equal.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock