Question: Assuming that CAPM is established, answer the questions in the following figure, except that CML represents the Capital Market Line, and rf=0.05 the risk free

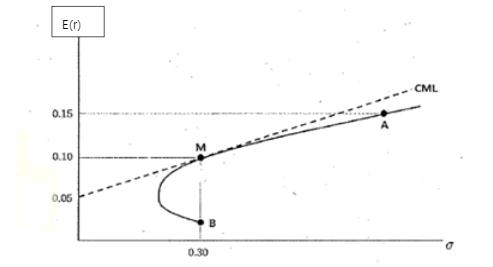

Assuming that CAPM is established, answer the questions in the following figure, except that CML represents the Capital Market Line, and rf=0.05 the risk free interest rate, respectively.

(1) Find the covariance between portfolios A and M. (2) If the portfolio created by investing x in portfolio A and y in portfolio M drawn on the graph is called B, find the weights x and y of the portfolio (however, x + y = 1) The beta of B is -0.5. (3) Calculate the non-systematic risk of portfolio B. (4) Assume that there are no risk-free assets. Find a zero-beta portfolio to replace risk-free assets. Find a zero-beta portfolio of A and B and plot it on a plane.

E(r) CML 0.15 0.10 0,05 0.30

Step by Step Solution

There are 3 Steps involved in it

Solution Assuming portfolio B is market portfolto Then its be ta ... View full answer

Get step-by-step solutions from verified subject matter experts