Question: Assuming that Frank will invest all $100,000, develop a linear programming model to determine the amount to be invested in each products so that the

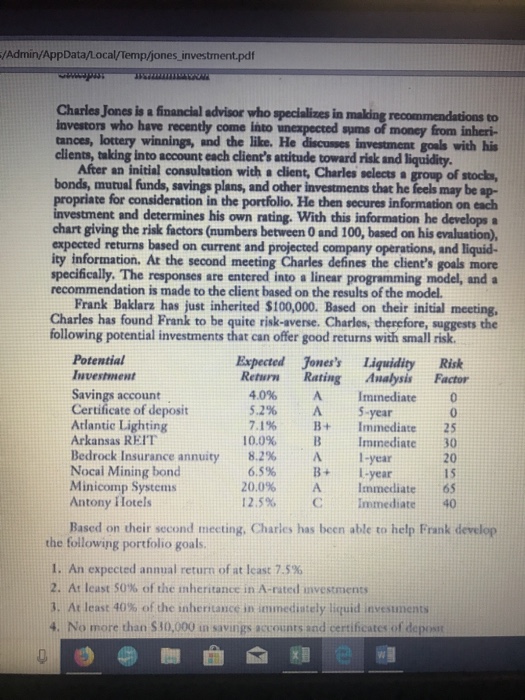

/Admin/AppData/Local/Temp/jones investment.pdf Charles Jones is a financial advisor who specializes in making recommendations to investors who have recently come into unexpected sums of money from inheri- tances, lottery winnings, and the like. He discusses investment goals wich his clients, taking into account each client's attitude toward risk and liquidity. After an initial consultation with a client, Charles selects a group of stocks, bonds, mutual funds, savings plans, and other investments that he feels may be ap- propriate for consideration in the portfolio. He then secures information on each investment and determines his own rating. With this information he develops chart giving the risk factors (numbers between 0 and 100, based on his evaluation) expected returns based on current and projcted company operations, and liquid- ity information. At the second meeting Charles defines the client's goals more specifically. The responses are entered into a linear programming model, and a recommendation is made to the client based on the results of the model. Frank Baklarz has just inherited $100,000. Based on their initial meeting, Charles has found Frank to be quite risk-averse. Charles, therefore, suggests the following potential investments that can offer good returns with small risk. Potential Iuvestment Expected Jones's Liquidity Risk Return Rating Anabysis Factor Savings account Certificate of deposit Atlantic Lighting Arkansas REIT Bedrock Insurance annuity Nocal Mining bond Minicomp Systems Antony Hotels 4.0% A Immediate 0 52% 71% B+ Immediate 25 10.0% B Immediate 30 8.2% 6.5% A 5-year 20 15 20.0% A inmediate 65 A B+ 1-year 1-year 12.5% C Immediate 40 Based on their second mecting. Charles has been able to help Frank develop the following portfolio goals I. An expected annual return of at least 7.5% 2. At least 50% of the inheritance in A-rated investments 3. At least 40% of the inheritance in illimediately liquid investments 4. No more than $30,000 in savings accounts and certificates of deposit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts