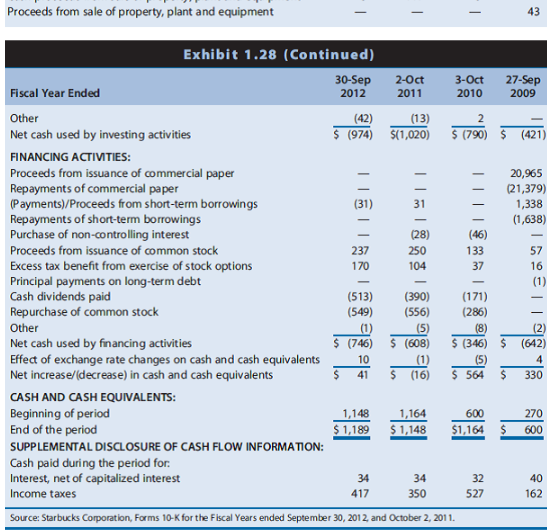

Question: Assuming that Starbucks had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short

Assuming that Starbucks had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2012? Explain.

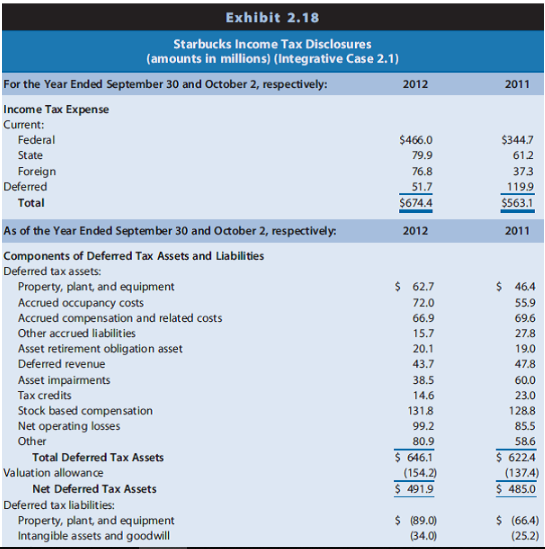

Exhibit 2.18 Starbucks Income Tax Disclosures (amounts in millions) (Integrative Case 2.1) For the Year Ended September 30 and October 2, respectively: 2012 2011 Income Tax Expense Current: Federal State Foreign 466.0 79.9 76.8 51.7 674.4 344.7 61.2 373 119.9 $563.1 Deferred Total As of the Year Ended September 30 and October 2, respectively 2012 2011 Components of Deferred Tax Assets and Liabilities Deferred tax assets: Property, plant, and equipment Accrued occupancy costs Accrued compensation and related costs Other accrued liabilities Asset retirement obligation asset Deferred revenue Asset impairments Tax credits Stock based compensation Net operating losses Other $ 62.7 72.0 66.9 15.7 20.1 43.7 38.5 14.6 1318 99.2 80.9 646.1 (154.2) 491.9 $ 464 55.9 69.6 27.8 19.0 47.8 60.0 23.0 128.8 85.5 58.6 6224 (137.4) 485.0 Total Deferred Tax Assets Valuation allowance Net Deferred Tax Assets Deferred tax liabilities: Property, plant, and equipment Intangible assets and goodwill $ (89.0) 34.0) s (66.4) (25.2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts