Question: Assuming that the allowance method is being used, prepare general journal entries without explanations to record the following transactions. Omit cost of goods sold entries.

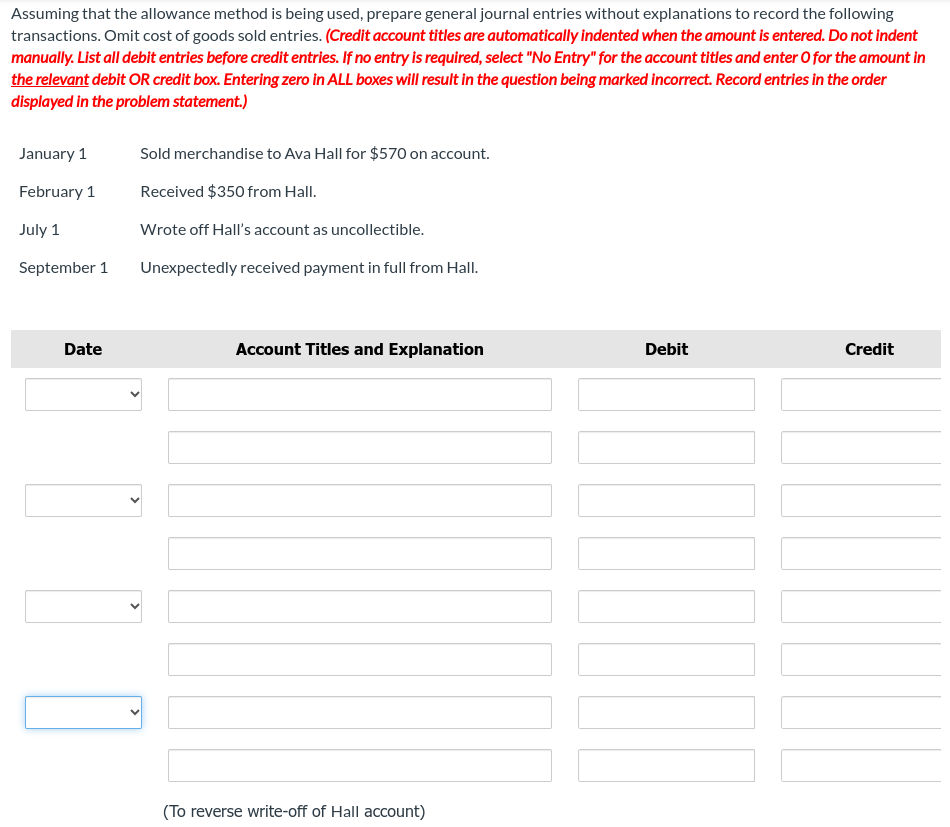

Assuming that the allowance method is being used, prepare general journal entries without explanations to record the following transactions. Omit cost of goods sold entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select No Entry" for the account titles and enter O for the amount in the relevant debit OR credit box. Entering zero in ALL boxes will result in the question being marked incorrect. Record entries in the order displayed in the problem statement.

January quad Sold merchandise to Ava Hall for $ on account.

February quad Received $ from Hall.

July quad Wrote off Hall's account as uncollectible.

September quad Unexpectedly received payment in full from Hall.

To reverse writeoff of Hall account

To reverse writeoff of Hall account

To record collection from Hall

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock