Question: Assuming that you work as a top executive manager for a conglomerate that constantly explores a broad range of investment projects across several industry sectors.

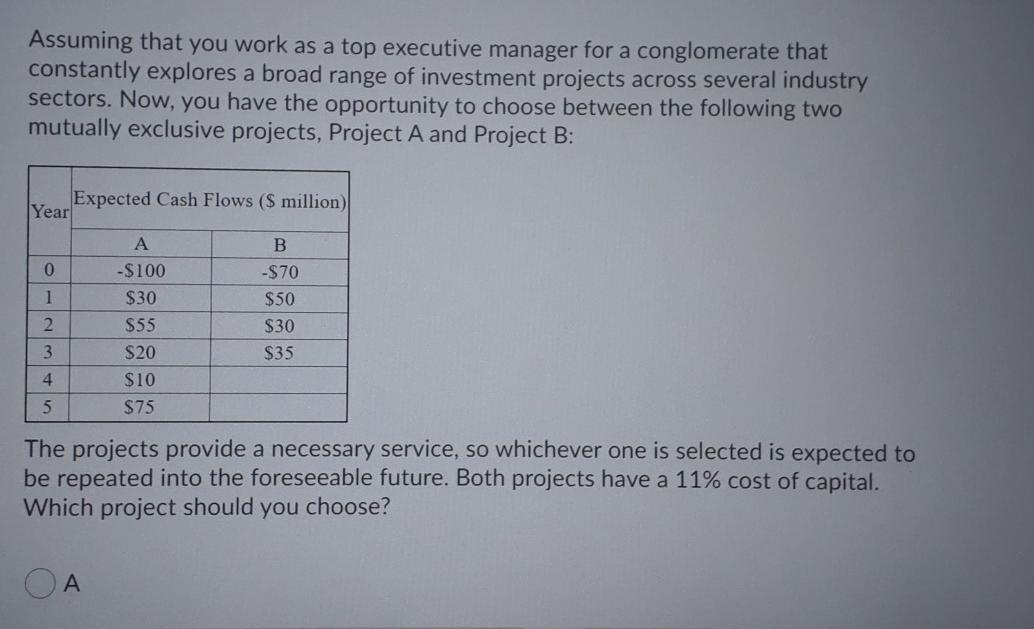

Assuming that you work as a top executive manager for a conglomerate that constantly explores a broad range of investment projects across several industry sectors. Now, you have the opportunity to choose between the following two mutually exclusive projects, Project A and Project B: Expected Cash Flows ($ million) Year B 0 1 A -$100 $30 $55 $20 $10 $75 -$70 $50 $30 $35 2 3 4 5 The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 11% cost of capital. Which project should you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts