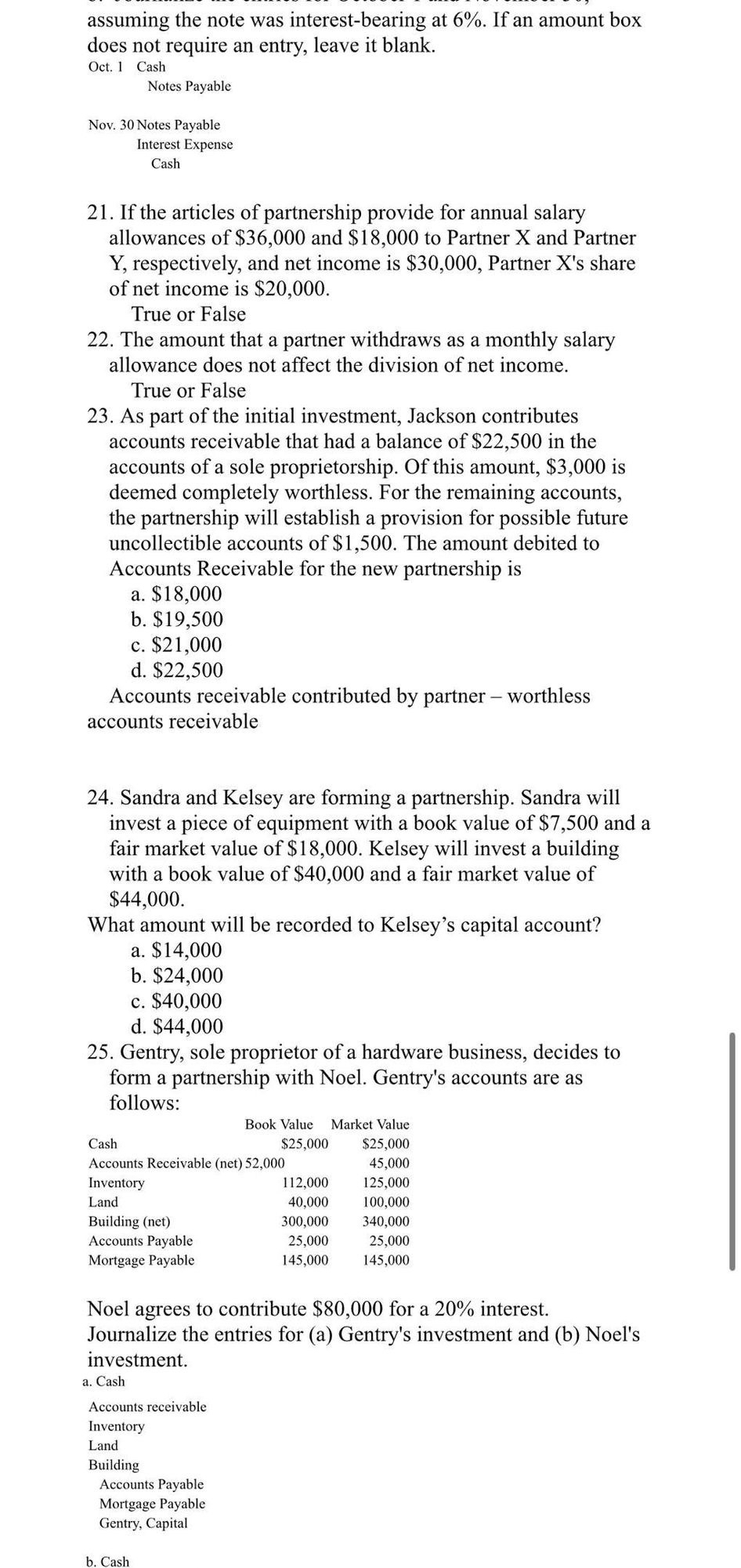

Question: assuming the note was interest - bearing at 6 % . If an amount box does not require an entry, leave it blank. Oct. 1

assuming the note was interestbearing at If an amount box does not require an entry, leave it blank.

Oct. Cash

Notes Payable

Nov. Notes Payable

Interest Expense

Cash

If the articles of partnership provide for annual salary allowances of $ and $ to Partner X and Partner Y respectively, and net income is $ Partner Xs share of net income is $

True or False

The amount that a partner withdraws as a monthly salary allowance does not affect the division of net income.

True or False

As part of the initial investment, Jackson contributes accounts receivable that had a balance of $ in the accounts of a sole proprietorship. Of this amount, $ is deemed completely worthless. For the remaining accounts, the partnership will establish a provision for possible future uncollectible accounts of $ The amount debited to Accounts Receivable for the new partnership is

a $

b $

c $

d $

Accounts receivable contributed by partner worthless accounts receivable

Sandra and Kelsey are forming a partnership. Sandra will invest a piece of equipment with a book value of $ and a fair market value of $ Kelsey will invest a building with a book value of $ and a fair market value of $

What amount will be recorded to Kelsey's capital account?

a $

b $

c $

d $

Gentry, sole proprietor of a hardware business, decides to form a partnership with Noel. Gentry's accounts are as follows:

tableBook Value,Market ValueCash$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock