Question: assuming WACC is 7%, calculate Project B's net present value. calculate each projects internal rate of return; which project is superior according to IRR calculate

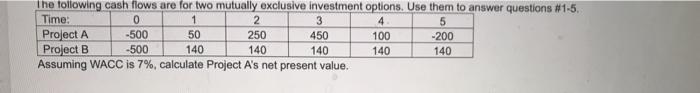

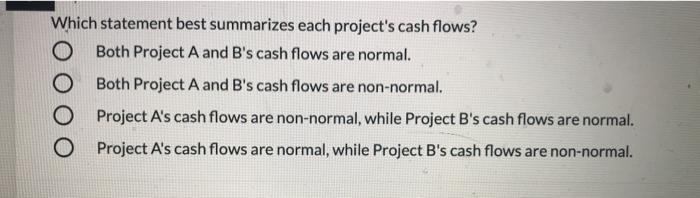

The following cash flows are for two mutually exclusive investment options. Use them to answer questions #1-5. Time: 0 1 2 3 4 5 Project A -500 50 250 450 100 -200 Project B -500 140 140 140 140 140 Assuming WACC is 7%, calculate Project A's net present value. Which statement best summarizes each project's cash flows? O Both Project A and B's cash flows are normal. O Both Project A and B's cash flows are non-normal. O Project A's cash flows are non-normal, while Project B's cash flows are normal. Project A's cash flows are normal, while Project B's cash flows are non-normal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts