Question: Assumption 1: 50 weeks in 1 year. Assumption 2: Holding costs are based on an annual interest rate of 10%. Precision Machine Company (PMC) produces

Assumption 1: 50 weeks in 1 year.

Assumption 2: Holding costs are based on an annual interest rate of 10%.

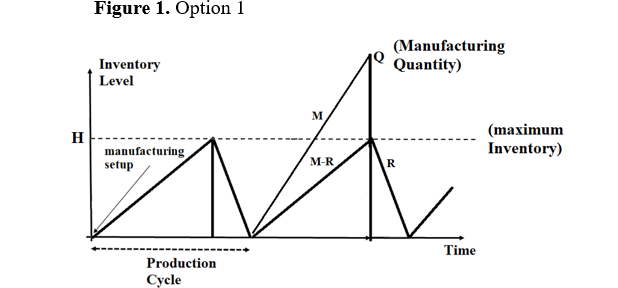

Precision Machine Company (PMC) produces computer part labeled PC1 for computer manufacturers. The manufacturers weekly demand, R, of the computer part is R = 10 parts/week. PMC has two supply options. (1) Option 1: PMC buys essential part form a Japanese supplier (unit purchasing cost = $200/unit), uses it to manufacture computer part PC1 (unit manufacturing cost = $100/unit), and sells them to computer manufacturers. The manufacturing rate, M, of the computer part is M = 20 units/week. At the beginning of each production cycle, it costs PMC a Manufacturing Setup Cost (MSC)=$4,000 for setting up the production cycle. (Example: Assume that in each production cycle PMC produces Q=250 units of computer parts. Then, there are 2 production cycles in a year (R/Q=500/250=2); thus, PMCs annual MSC cost is 2*$4,000=$8,000). Figure 1.

Option 1 (a) (a.1) Note that (see Figure 1) H=Qy. Determine what is y=.

(a.2) Determine the optimal manufacturing quantity (Q) that minimizes the annual inventory cost (AIC).

(a.3) Computes AIC. AIC = Annual MSC Cost + Annual Holding Cost + Annual (purchasing + manufacturing) Cost

Figure 1. Option 1 Inventory Level (Manufacturing Quantity) M H (maximum Inventory) manufacturing setup M-R R Time Production CycleStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts