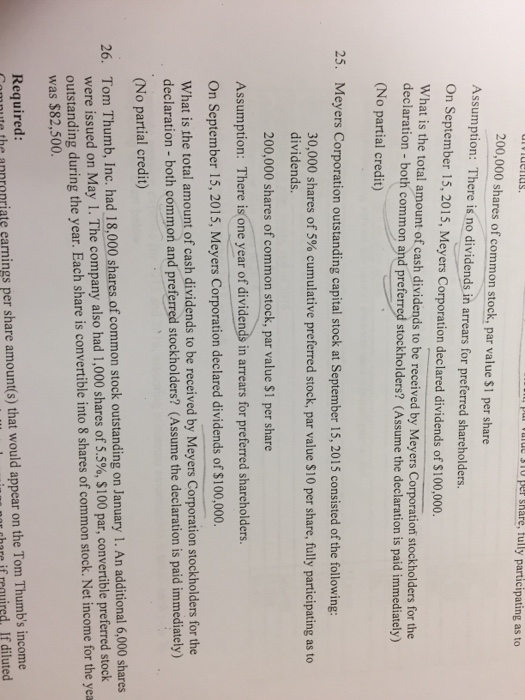

Question: Assumption: There it no dividends in arrears for preferred shareholders. September 15, 2015, Meyers Corporation declared dividends of $100,000. What is the total amount of

Assumption: There it no dividends in arrears for preferred shareholders. September 15, 2015, Meyers Corporation declared dividends of $100,000. What is the total amount of cash dividends to be received by Meyers Corporation stockholders for the declaration - both common and preferred stockholders? (Assume the declaration is paid immediately) Meyers Corporation outstanding capital stock at September 15, 2015 consisted of the following: 30,000 shares of 5% cumulative preferred stock, par value $10 per share, fully participating as to dividends. 200,000 shares of common stock, par value $1 per share Assumption: There is one year of dividends in arrears for preferred shareholders. On September 15, 2015, Meyers Corporation declared dividends of $100,000. What is the total amount of cash dividends to be received by Meyers Corporation stockholders for the declaration - both common and preferred stockholders? (Assume the declaration is paid immediately) (No partial credit) Tom Thumb, Inc had 18,000 shares of common stock outstanding on January 1. An additional 6,000 shares were issued on May 1. The company also had 1,000 shares of 5.5%, $100 par. convertible preferred stock outstanding during the year. Each share is convertible into 8 shares of common stock. Net income for the year was $82, 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts