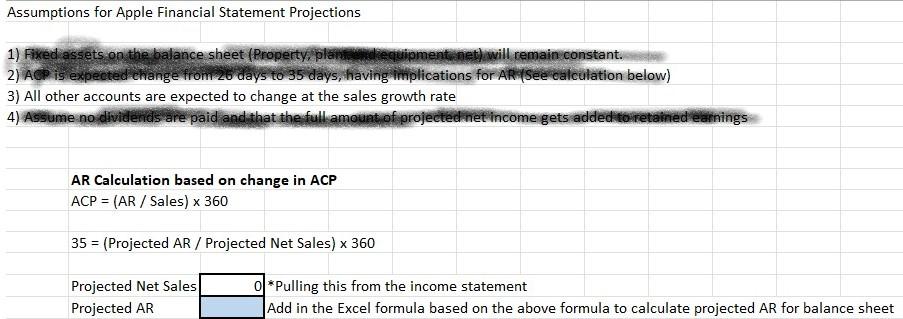

Question: Assumptions for Apple Financial Statement Projections 1) Fixed assets on the balance sheet (Property, plaimendequipent wiet) will remain constant. 2) ACP is expected enange from

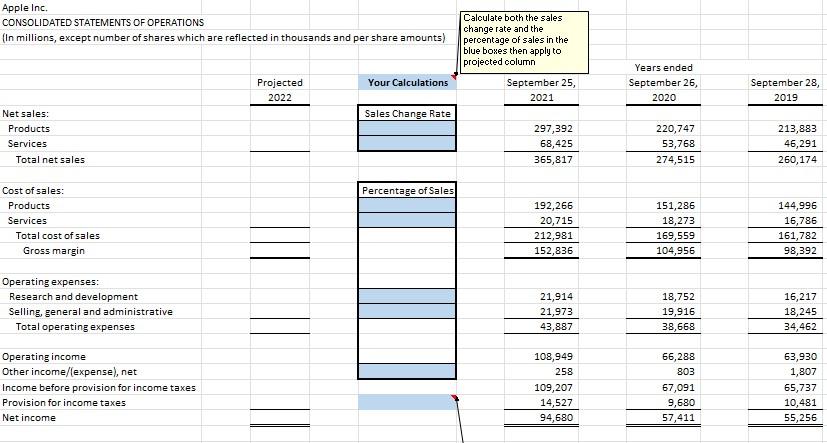

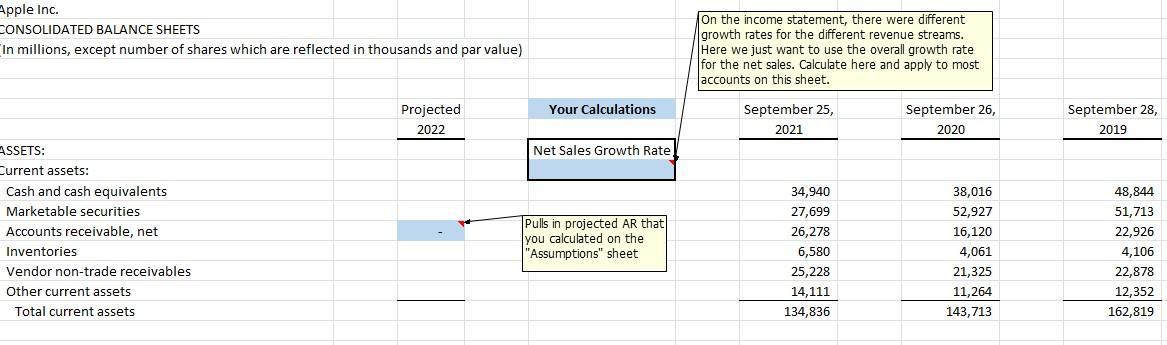

Assumptions for Apple Financial Statement Projections 1) Fixed assets on the balance sheet (Property, plaimendequipent wiet) will remain constant. 2) ACP is expected enange from 26 days to 35 days, having implications for ARi(see calculation below) 3) All other accounts are expected to change at the sales growth rate 4) Assume no dividends are paid and that the fullamount of projectednet income gets added toitetained earning AR Calculation based on change in ACP ACP=(AR/Sales)360 Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS Calculate both the sales (In millions, except number of shares which are reflected in thousands and per share amounts) change rate and the percentage of sales in the blue bores then apply to projected column Net sales: Products Services Total net sales \begin{tabular}{|l|} \hline Sales Change Rate \\ \hline \\ \hline \end{tabular} Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Apple Inc. CONSOLIDATED BALANCE SHEETS On the income statement, there were different In millions, except number of shares which are reflected in thousands and par value) growth rates for the different revenue streams. Here we just want to use the overall growth rate for the net sales. Calculate here and apply to most accounts on this sheet. ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets \begin{tabular}{l} Projected \\ 2022 \\ \hline \end{tabular} Your Calculations \begin{tabular}{c} September 28, \\ 2019 \\ \hline \end{tabular} Pulls in projected AR that you calculated on the "Assumptions" sheet 34,94027,69926,2786,58025,22814,111134,836 \begin{tabular}{|r|} \hline 38,016 \\ \hline 52,927 \\ \hline 16,120 \\ \hline 4,061 \\ \hline 21,325 \\ \hline 11,264 \\ \hline 143,713 \\ \hline \end{tabular} \begin{tabular}{r|} \hline 48,844 \\ \hline 51,713 \\ \hline 22,926 \\ \hline 4,106 \\ \hline 22,878 \\ \hline 12,352 \\ \hline 162,819 \\ \hline \end{tabular} Assumptions for Apple Financial Statement Projections 1) Fixed assets on the balance sheet (Property, plaimendequipent wiet) will remain constant. 2) ACP is expected enange from 26 days to 35 days, having implications for ARi(see calculation below) 3) All other accounts are expected to change at the sales growth rate 4) Assume no dividends are paid and that the fullamount of projectednet income gets added toitetained earning AR Calculation based on change in ACP ACP=(AR/Sales)360 Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS Calculate both the sales (In millions, except number of shares which are reflected in thousands and per share amounts) change rate and the percentage of sales in the blue bores then apply to projected column Net sales: Products Services Total net sales \begin{tabular}{|l|} \hline Sales Change Rate \\ \hline \\ \hline \end{tabular} Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Apple Inc. CONSOLIDATED BALANCE SHEETS On the income statement, there were different In millions, except number of shares which are reflected in thousands and par value) growth rates for the different revenue streams. Here we just want to use the overall growth rate for the net sales. Calculate here and apply to most accounts on this sheet. ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets \begin{tabular}{l} Projected \\ 2022 \\ \hline \end{tabular} Your Calculations \begin{tabular}{c} September 28, \\ 2019 \\ \hline \end{tabular} Pulls in projected AR that you calculated on the "Assumptions" sheet 34,94027,69926,2786,58025,22814,111134,836 \begin{tabular}{|r|} \hline 38,016 \\ \hline 52,927 \\ \hline 16,120 \\ \hline 4,061 \\ \hline 21,325 \\ \hline 11,264 \\ \hline 143,713 \\ \hline \end{tabular} \begin{tabular}{r|} \hline 48,844 \\ \hline 51,713 \\ \hline 22,926 \\ \hline 4,106 \\ \hline 22,878 \\ \hline 12,352 \\ \hline 162,819 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts