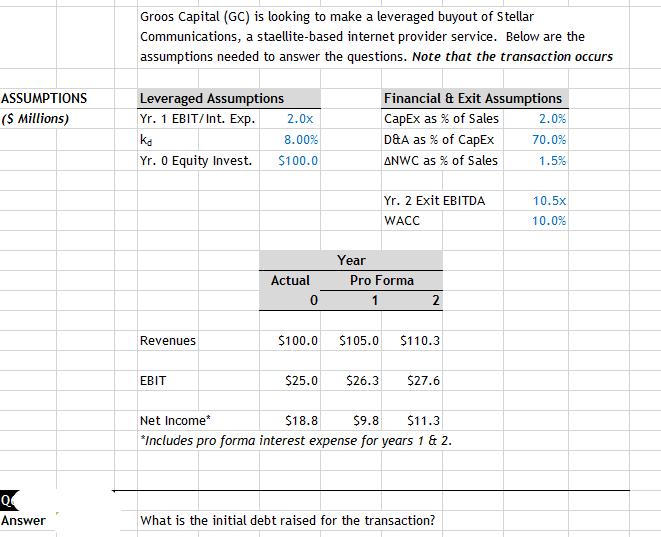

Question: ASSUMPTIONS ($ Millions) Q Answer Groos Capital (GC) is looking to make a leveraged buyout of Stellar Communications, a staellite-based internet provider service. Below

ASSUMPTIONS ($ Millions) Q Answer Groos Capital (GC) is looking to make a leveraged buyout of Stellar Communications, a staellite-based internet provider service. Below are the assumptions needed to answer the questions. Note that the transaction occurs Leveraged Assumptions Yr. 1 EBIT/Int. Exp. Ka Yr. 0 Equity Invest. Revenues EBIT 2.0x 8.00% $100.0 Actual 0 $100.0 $25.0 Year Financial & Exit Assumptions CapEx as % of Sales D&A as % of CapEx ANWC as % of Sales Yr. 2 Exit EBITDA WACC Pro Forma 1 2 $105.0 $110.3 $26.3 $27.6 Net Income* $18.8 $9.8 $11.3 *Includes pro forma interest expense for years 1 & 2. What is the initial debt raised for the transaction? 2.0% 70.0% 1.5% 10.5 10.0%

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

The initial debt raised for the transaction can be calculated by using the leveraged assumptions pro... View full answer

Get step-by-step solutions from verified subject matter experts