Question: Astral Poly Technik had fixed 19 March 2021 as record date for of ascertaining the eligibility of shareholders entitled for issuance of Bonus Equity Shares

Astral Poly Technik had fixed 19 March 2021 as record date for of ascertaining the eligibility of shareholders entitled for issuance of Bonus Equity Shares in the proportion of 1 (One) Equity Shares of Re. 1/- each for every 3 (Three) existing Equity Shares of Re. 1/- each.

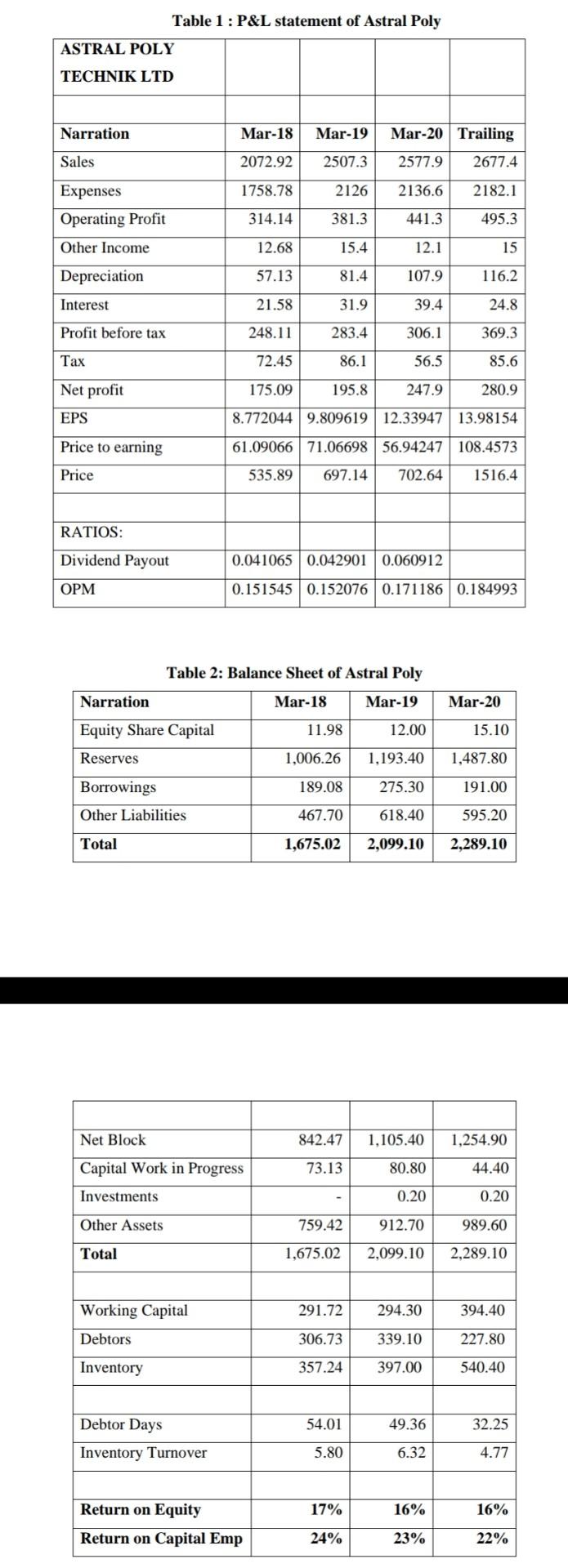

a. In light of the bonus announcement and the financial information given above what could be the reason/s for Astral Poly to issue bonus shares.What other alternatives did it have ? ( Give your answer specific to the company,generic answers will not be accepted) b. In light of the bonus announcement and the financial information given above , what do you think would be the impact of issuance of bonus shares of Astral on i. EPS of the company ii. Share price of the company.

Table 1 : P&L statement of Astral Poly ASTRAL POLY TECHNIK LTD Narration Mar-18 Mar-19 Mar-20 Trailing 2577.9 2677.4 Sales 2072.92 2507.3 1758.78 2126 2136.6 2182.1 Expenses Operating Profit 314.14 381.3 441.3 495.3 Other Income 12.68 15.4 12.1 15 Depreciation 57.13 81.4 107.9 116.2 Interest 21.58 31.9 39.4 24.8 Profit before tax 248.11 283.4 306.1 369.3 Tax 72.45 86.1 56.5 85.6 Net profit 175.09 195.8 247.9 280.9 EPS 8.7720449.80961912.33947 13.98154 Price to earning 61.09066 71.06698 56.94247 108.4573 535.89 697.14 702.64 1516.4 Price RATIOS: Dividend Payout 0.041065 0.042901 0.060912 OPM 0.151545 0.152076 0.171186 0.184993 Table 2: Balance Sheet of Astral Poly Narration Mar-18 Mar-19 Mar-20 11.98 12.00 15.10 Equity Share Capital Reserves 1,006.26 1,193.40 1,487.80 Borrowings 189.08 275.30 191.00 Other Liabilities 467.70 618.40 595.20 Total 1,675.02 2,099.10 2,289.10 842.47 1,105.40 1,254.90 Net Block Capital Work in Progress 73.13 80.80 44.40 Investments 0.20 0.20 Other Assets 912.70 989.60 759.42 1,675.02 Total 2,099.10 2,289.10 Working Capital 291.72 294.30 394.40 Debtors 306.73 339.10 227.80 Inventory 357.24 397.00 540.40 Debtor Days 54.01 49.36 32.25 Inventory Turnover 5.80 6.32 4.77 17% 16% 16% Return on Equity Return on Capital Emp 24% 23% 22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts