Question: Asup Consulting sometimes performs services for which it receives poyment at the conchivion of the engwineert, wo to sik monts purposes, revenue is reponed when

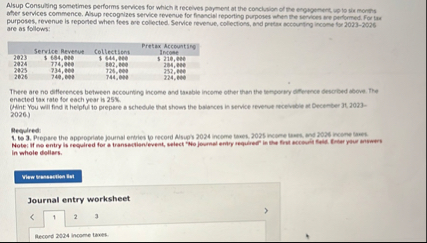

Asup Consulting sometimes performs services for which it receives poyment at the conchivion of the engwineert, wo to sik monts purposes, revenue is reponed when fees ave colected. Service reverue, colections, movd pritur mocourting income for are as follow:

tableService Reverut,Collectisha,Pretax Accpunting Incose eet

There are no differences between accounting income and taxable income other than the temporary differ enacted tax rate for each year is

Hint: You will find it helpful to prepare a schedule that shows the balances in service revenue recelvable

Required:

to Prepare the appropriate journal entries to record Alsup's income taxes, income taxes, Note: If no entry is required for a transactionevent select No journal entry required" in the first acco in whole dollars.

Record income taxes.

Record income taxes.

Record income taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock