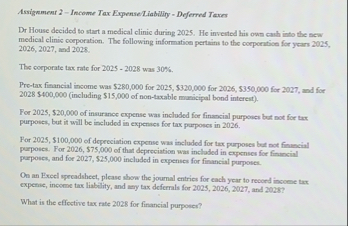

Question: Asxignment 2 - Income Tax Expense Liability - Deferred Texes Dr House decided to start a medical clinic during 2 0 2 5 . He

Asxignment Income Tax Expense Liability Deferred Texes

Dr House decided to start a medical clinic during He inverted his own calh into the sew medical clinic corporation. The following informatioe pertains to the coeporition for years and

The corporate tax rate for was

Pretax fennctat income was $ for for for and for $including $ of nontaxable mumicipal bond interent

For $ of insurance expense was included for financial purpones but not for tax purposes, but it will be included in expenses for tax praposes in

For $ of depreciation expense was included for tax purpones bet not finseial perposes. For $ of that depreciation was incloded in expenses for finurcial perposes, and for included in expenses for finuncial purposes.

On an Exeel spreadsheet, please show the joumal entries for each year to record income lax expense, income tax liability, and ary tax deferrals for and

What is the effective tax rate for financial purposed?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock