Question: At 4 8 , you settle back down at a new job. Your starting salary is $ 1 8 0 , 0 0 0 per

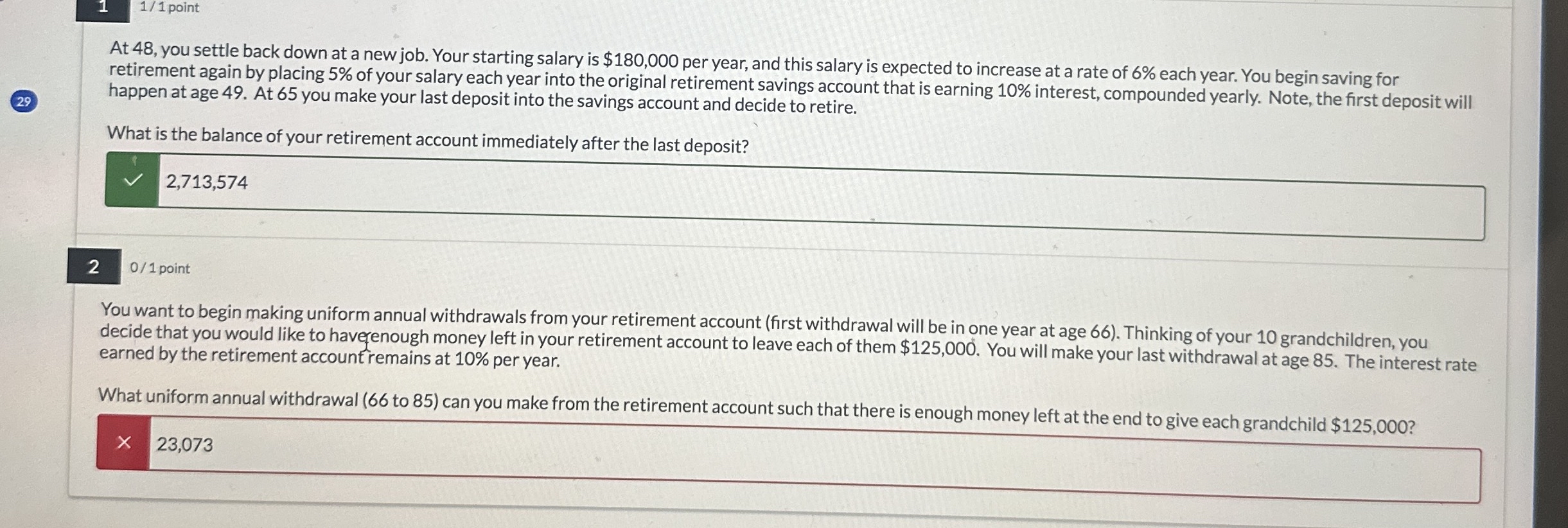

At you settle back down at a new job. Your starting salary is $ per year, and this salary is expected to increase at a rate of each year. You begin saving for

retirement again by placing of your salary each year into the original retirement savings account that is earning interest, compounded yearly. Note, the first deposit will

happen at age At you make your last deposit into the savings account and decide to retire.

What is the balance of your retirement account immediately after the last denosit?

point

You want to begin making uniform annual withdrawals from your retirement account first withdrawal will be in one year at age Thinking of your grandchildren, you

decide that you would like to haverenough money left in your retirement account to leave each of them $ You will make your last withdrawal at age The interest rate

earned by the retirement account 'remains at per year.

What uniform annual withdrawal to can you make from the retirement account such that there is enough money left at the end tn oive osoh

point

At you finish college and are fortunate enough to have a job waiting for you. Your first job has a starting salary of $ per year. This salary is expected to increase by

$ each year. You decide to start saving for retirement right away. Each year you invest of the year's salary in an account that earns interest, compounded yearly.

For simplicity, assume the deposit is made at the END of each year so if age is then the first deposit will be at age

If you continue to save in this manner, how much will be in your retirement account immediately after you make the deposit at age

point

When you are you win $ in the lottery. You decide to spend half of your winnings immediately and place the other half in your retirement savings account which is

earning interest at per year. At after making the retirement account deposit you decide to quit your job and take a twoyear trip around the world. To help finance this

trip, you withdraw of the current balance in your retirement savings account.

At you settle back down at a new job. Your starting salary is $ per year, and this salary is expected to increase at a rate of each year. You begin saving for

retirement again by placing of your salary each year into the original retirement savings account that is earning interest, compounded yearly. Note, the first deposit will

happen at age At you make your last deposit into the savings account and decide to retire.

What is the balance of your retirement account immediately after the last denosit?

point

You want to begin making uniform annual withdrawals from your retirement account first withdrawal will be in one year at age Thinking of your grandchildren, you

decide that you would like to haverenough money left in your retirement account to leave each of them $ You will make your last withdrawal at age The interest rate

earned by the retirement account 'remains at per year.

What uniform annual withdrawal to can you make from the retirement account such that there is enough money left at the end tn oive osoh

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock