Question: Question: 2 Some recent data for Rita Corp's stock, which is currently selling at $12 per share, is as follows: (1) initial beta 1.00,

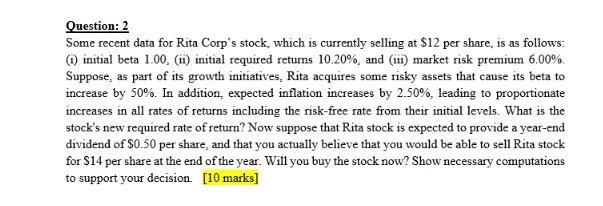

Question: 2 Some recent data for Rita Corp's stock, which is currently selling at $12 per share, is as follows: (1) initial beta 1.00, (ii) initial required returns 10.20%, and (ii) market risk premium 6.00%. Suppose, as part of its growth initiatives, Rita acquires some risky assets that cause its beta to increase by 50%. In addition, expected inflation increases by 2.50%, leading to proportionate increases in all rates of returns including the risk-free rate from their initial levels. What is the stock's new required rate of return? Now suppose that Rita stock is expected to provide a year-end dividend of $0.50 per share, and that you actually believe that you would be able to sell Rita stock for $14 per share at the end of the year. Will you buy the stock now? Show necessary computations to support your decision. [10 marks]

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Answer 1 The new required rate of return for Rita Corps stock with the increased beta of 150 and increased riskfree rate and market risk premium will ... View full answer

Get step-by-step solutions from verified subject matter experts